Thinking of getting a new credit card from HDFC, but have no clue which one to choose? Well, then here is a detailed comparison of HDFC Millennia credit card vs Regalia First which is better! This will help you find a card that will fit your requirements and spending pattern. We will also learn about HDFC Millennia Credit Card vs Moneyback, Regalia First Credit Card benefits and HDFC Regalia First Credit Card reward points redemption. After going through this comparison, you will get a better understanding of the features, benefits, eligibility criteria, fees, etc. of each card. Read on to know more!

Table of Contents

HDFC Millennia Vs Regalia First Which Is the Better?

HDFC, headquartered in Mumbai and established in 1994 is one of the largest private banks in India. They have served around 7.10 crores of customers across India as of 2021. HDFC is known to have some of the best financial products for retail customers ranging from savings/current accounts to mutual funds, loans, and credit cards.

Their credit cards are known to have special benefits and reward systems that can be highly advantageous for card holders. All their cards are designed keeping in mind different customer categories so that everyone can find something as per their eligibility. Millenia and Regalia are two such popular cards that customers can choose from. This will help choose between HDFC Millennia credit card vs moneyback offers that they offer.

Regalia and Millennia are categories of cards in which one can find both debit and credit cards. Launched back in 2012, Regalia is older than Millennia. Regalia First is a common card type under the category. It has some added benefits when compared to the original Regalia card. On the other hand, the Millennia card was launched in 2019 and relaunched in 2021 with some added benefits and features.

In the beginning, HDFC had a very popular credit card, called All Miles credit card. This was a super popular choice among the customers who were not eligible for the Regalia card. However, it got discontinued.

After this, HDFC Regalia First as their alternative to All Miles card with similar features and benefits. Regalia First is the base level card in the Regalia card category. This is meant for those who are not looking to spend a lot on joining fees and spent minimally on shopping, travel, etc.

Millenia card, on the other hand, is a new type of credit card that is designed keeping in mind the spending style and preferences of the millennials. It is a digital-first card and carries a lot of benefits and rewards for online shoppers. One of the main attractions of this credit card is the CashPoints, which are cashback points rewarded for online and offline shopping.

Now, let’s jump into the detailed comparison between both of them in HDFC Millennia credit card vs Regalia First which is better.

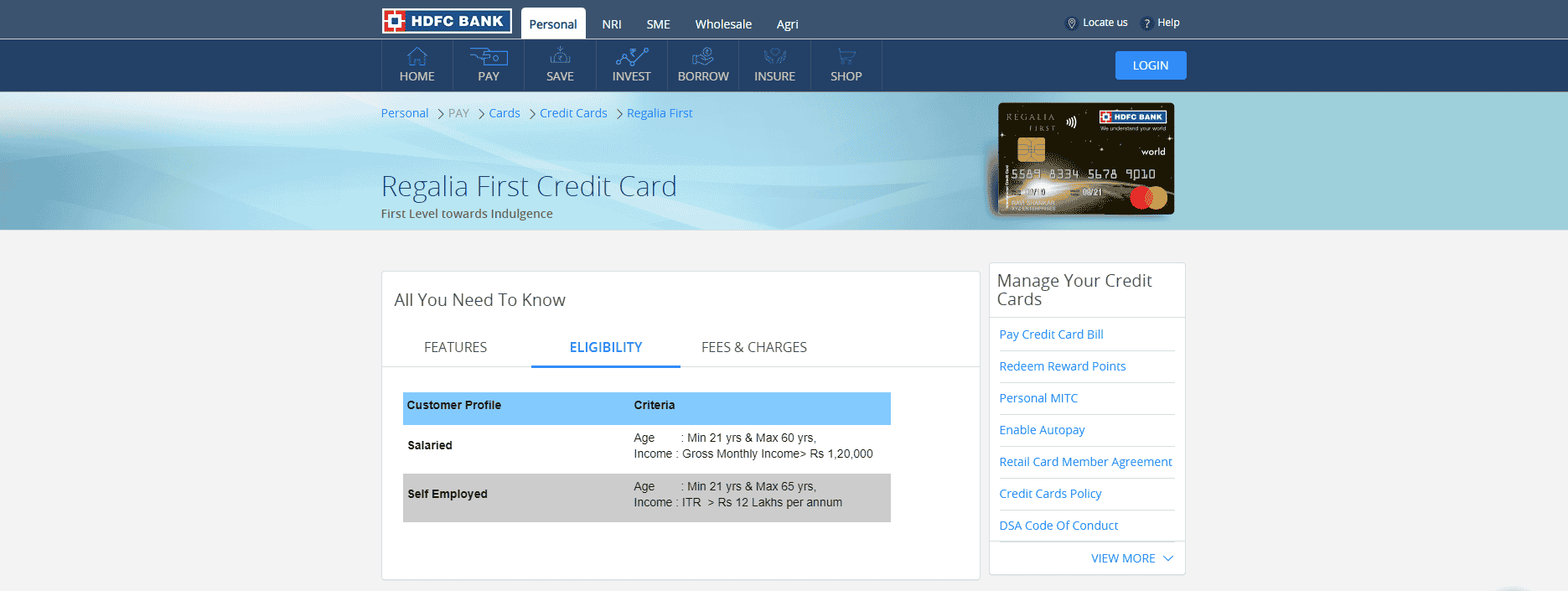

Eligibility Criteria

HDFC Regalia First Credit Card

This is a premium card, and therefore, people with a salary above Rs. 1,20,000 can only apply for this.

- The applicant should be an Indian citizen.

- The minimum age to apply for a credit card is 21 years, the maximum is 60 years and 65 years for self-employed individuals.

- The salaried applicant’s monthly income should be more than or equal to Rs. 1,20,000.

- A self-employed applicant’s annual ITR should be more than or equal to Rs. 12,00,000 p/a.

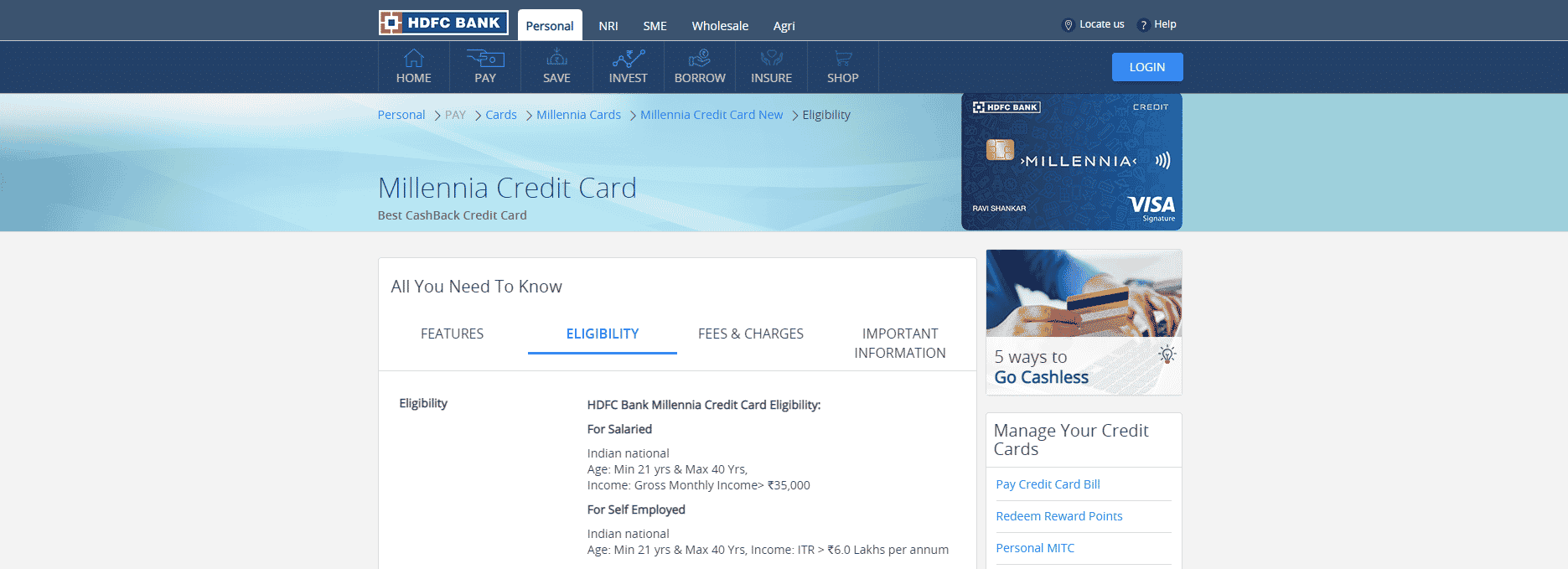

HDFC Millennia Credit Card

This is a basic card meant for young professionals with a base salary of Rs. 35,000.

- The applicant should be an Indian citizen.

- The minimum age to apply for a credit card is 21 years, and the maximum is 40 years for salaried individuals and for self-employed individuals.

- The salaried applicant’s monthly income should be more than or equal to Rs. 35,000.

- A self-employed applicant’s annual ITR should be more than or equal to Rs. 6,00,000.

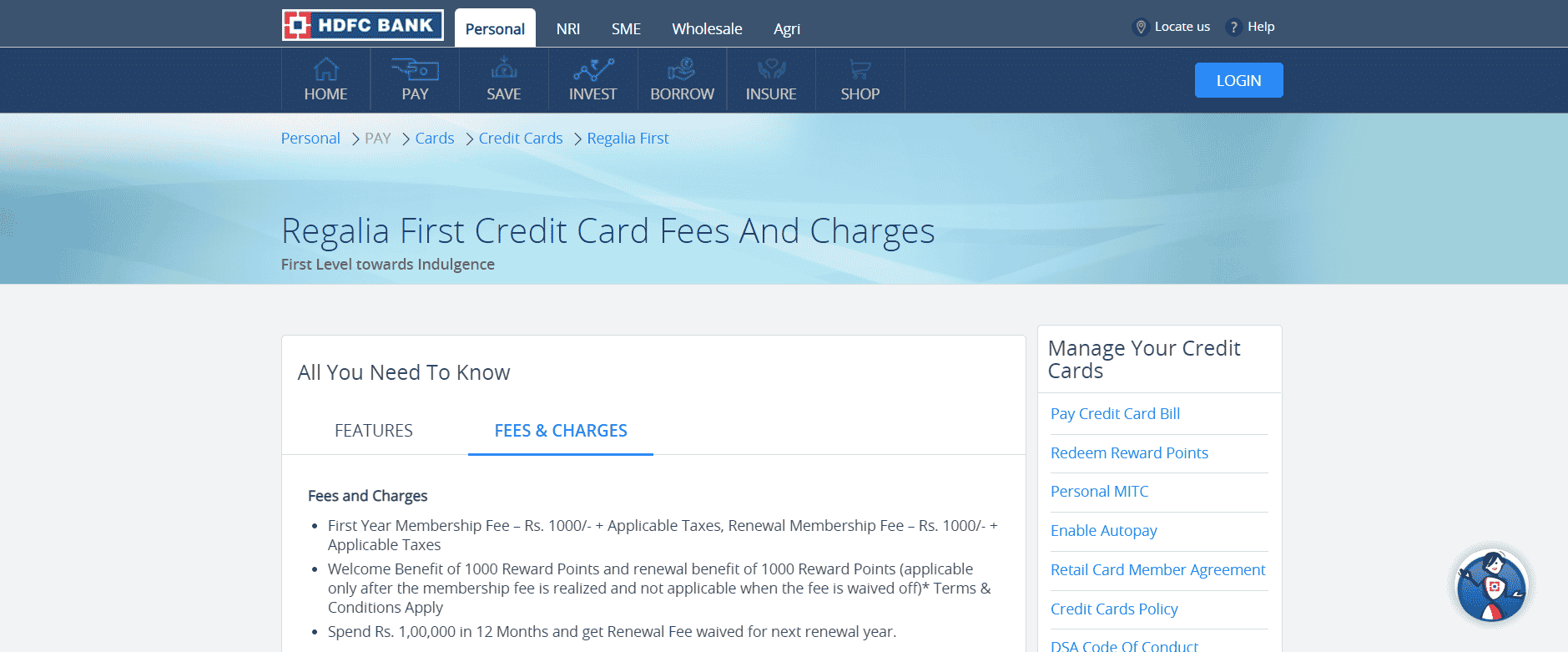

Joining & Renewal

HDFC Regalia First Credit Card

The annual fee for the HDFC Regalia First credit card is Rs. 1,000 + taxes. The card also charges Rs. 1,000 + taxes as a renewal fee to be paid annually. The renewal fee is waived off in case of expenditure of more than Rs. 1,00,000 on the card in the previous year.

On joining, customers will get a welcome bonus of 1000 rewards that they can redeem as cashback or as points for online shopping. Users will also get a renewal bonus of 1000 points as part of Regalia First’s credit card benefits. In case your renewal fee is waived off then, you cannot get access to the renewal bonus.

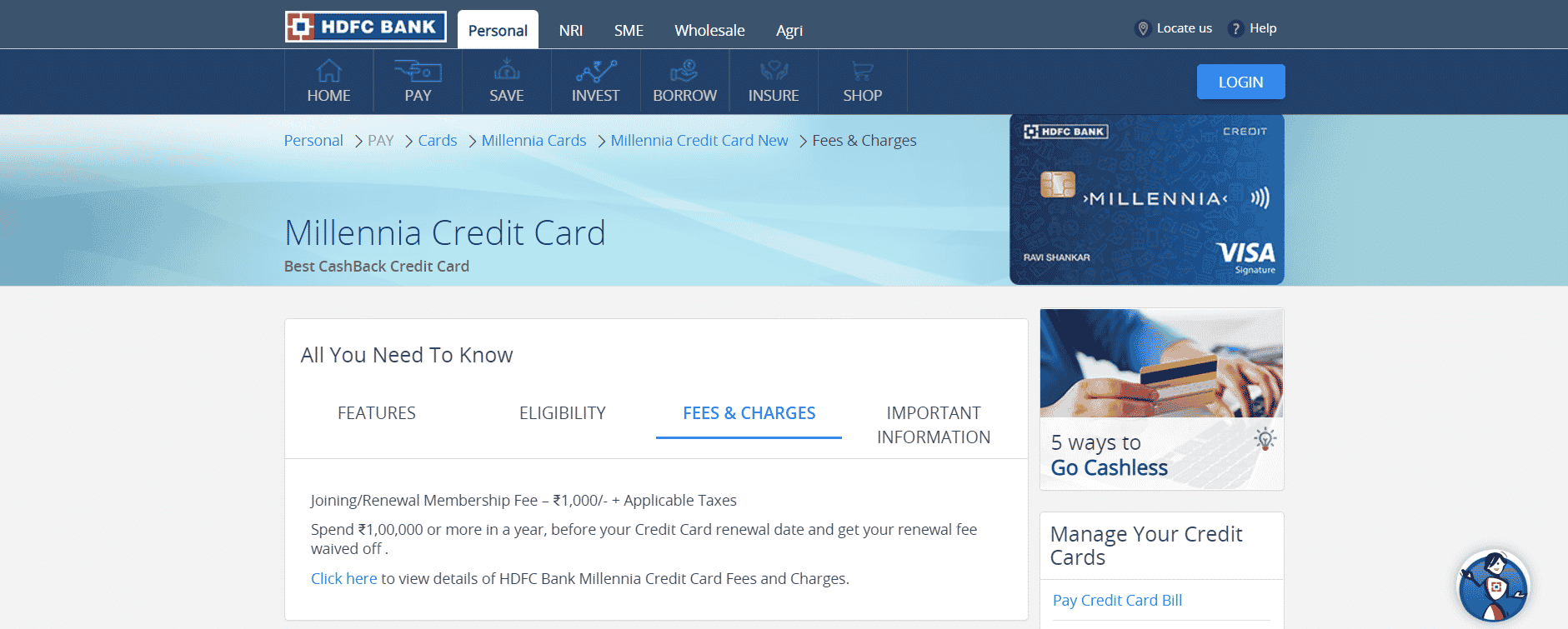

HDFC Millennia Credit Card

For the HDFC Millennia credit card, the joining fee is Rs. 1,000, and the renewal fee is Rs. 1,000 which is to be paid every year upon starting a new credit cycle. this fee is exclusive of taxes, which will be levied on the final bill.

If a person spends more than Rs. 30,000 in the first three months of the membership, then the membership fee is waived. Similarly, if the user makes use of the credit card to spend more than Rs. 1,00,000 in the entire credit cycle, then the renewal fee is waived off for the next cycle.

The users will get 1000 welcome CashPoints or rewards points for joining the credit card membership. It can be used for online purchases, hotel, and travel bookings or can be used to get a cashback on the credit statement.

Also Read: How to Check Credit Score Online?

Fees & Charges

Let’s compare the fees that one will have to pay for every card, to get a better view of HDFC Millennia credit card vs Regalia First which is better.

HDFC Regalia First Credit Card

| Rate of Interest | 3.49% Per Month |

| Cash Withdrawal Fee | 2.5% (Minimum – Rs. 500) |

| Foreign Exchange Mark-Up | 2% |

| Cash Advance Limit | 40% Of the Limit |

| Minimum Repayment Fee | 5% (Maximum – Rs. 200) |

| Add-On Fees | Nil |

| Redemption Fee | Nil |

| Over Limit Charges | 2.5% |

|

Late Fees |

Bill Amount:

|

| Payment Return Charges | 2% Of the Bill Amount (Minimum Amount: Rs. 450) |

| Re-Issue of Card Charges | Rs. 100 |

HDFC Millennia Credit Card

| Rate of Interest | 3.6% Per Month |

| Cash Withdrawal Fee | 2.5% (Minimum- Rs. 500) |

| Foreign Exchange Mark-Up | 3.5% |

| Cash Advance Fee | 2.5% |

| Redemption Fee | Nil |

| Over Limit Charges | 2.5% |

|

Late Fees |

Bill Amount:

|

| Payment Return Charges | 2% Of the Bill Amount (Minimum Amount: Rs. 450) |

| Re-Issue of Card Charges | Rs. 100 |

Features & Benefits

Following are the features and benefits to get a picture of HDFC Millennia credit card vs Regalia First which is better.

HDFC Regalia First Credit Card

Here are some of the benefits and rewards you can experience with Regalia First credit card:

- Retail Expenses: You will get 4 reward points per Rs.150 for every utility, rent, insurance, and educational bill payment. You can cashback with the help of the HDFC Regalia First credit card reward points redemption process.

- Milestone Benefits: If you spend more than or equal to Rs 6,00,000 in a year, you will get a reward of 2,500 points worth Rs. 750. And, if you spend more than or equal to Rs. 3,00,000 in a year, you will get 5000 reward points worth Rs. 1,500.

- Lounge Benefits: You will get 8 complimentary access to domestic lounges per annum. And if you avail for a priority pass, then you will get 3 complimentary international lounge access per year.

- Smartbuy Rewards: If you make purchases online on the SmartBuy platform, you will get accelerated 5% cashback on your expense.

- Dining Benefits: If you spend more than Rs. 75,000 on your credit card for paying restaurant bills, then you will get a minimum 35% discount per quarter. You can also avail 1+1 buffet feature in select restaurants and a 25% discount in 2000+ premium restaurants.

- Fuel Surcharge Waiver: Credit cardholders will get a 1% fuel surcharge waiver in all gas stations in India. The minimum bill should be Rs. 400 and the maximum should be Rs. 5000.

- Accident Coverage: You are also eligible for Rs. 5 lakh worth of credit liability cover, Rs.50 lakhs worth of accident air death cover, and Rs. 10 lakh worth of overseas hospitalization cover.

HDFC Millennia Credit Card

Here are some of the benefits and rewards you can experience with a Millennia credit card:

- Cashback Benefits: With the Millennia card, you will get a plethora of cashback reward benefits designed in the form of CashPoints. For all your offline payments and expenses, you will get 1% cashback with a maximum cap of Rs. 750. For your online SmartBuy payments at various online retailers like Amazon and Flipkart, you will get 5% cashback. The maximum cashback in this category is Rs. 1000 for the first six months and Rs. 750 after that. If you are making payments online or spending on any other website, then you can avail of a cashback worth 2.5% which is capped at Rs. 750 per month. You can redeem the cashpoints only if they are above the mark of Rs. 2000.

- Lounge Benefits: Those who are primary cardholders of HDFC millennia, will get 8 complimentary lounge access in domestic airports every year and 2 times in a quarter.

- Dining Benefits: With their Dineout passport, which is offered to new cardholders for the first three months, you can receive a 20 percent discount. Several eateries across the nation accept this offer. Benefits for premium restaurants under the Good Food Trail program are another program to which you have access. Select restaurants provide a 1+1 buffet along with drinks. Additionally, you can receive a guaranteed 25 percent discount at more than 2000 upscale restaurants.

- Contactless Payments: You can use your credit card for cashless payments. You can simply show the card to the payment terminals, and the payment will get deducted easily. If your bill is below Rs. 2000, there will be no need to provide a PIN, but above the amount, you will have to avail your PIN.

- Fuel Surcharge Waiver: All petrol stations in India will waive 1% of the fuel bill for credit card holders. The minimum and maximum payments should be Rs. 400 and Rs. 5000 rupees, respectively.

Drawbacks

Let’s compare the drawbacks of the two cards and understand HDFC Millennia credit card vs Regalia First which is better.

HDFC Regalia First Credit Card

- There is a lack of variety when it comes to rewards for online payments and platforms.

- Free priority pass membership is available only after 4 transactions.

- The default rewards rate is as low as 0.8%.

- Complementary insurance coverage is not for add-n members.

- Travel insurance coverage is for international traveling only.

- Under complementary travel benefits, co-branded products and air miles are not included, and only lounge access is provided.

Rewards points are valid only for 2 years for HDFC Regalia First credit card reward points redemption, after which it will expire.

HDFC Millennia Credit Card

- For fuel transactions, there is no cashback option.

- Rewards and cashback are eligible for higher purchases.

- For statement balance redemption using CashPoints, one should have a minimum of 2,500 points.

- In travel benefits, only domestic lounges are included and there are no international airport lounge benefits.

- There is a maximum cashback cap on all the categories of 1%, 2.5%, and 5%.

- The cashpoints will expire after one year.

Also Read: 10 Questions to Ask Before Applying for a Credit Card

Which One Is Better?

HDFC Regalia First is meant for those who are frequent users of credit cards and tend to use them for most of their expenses. You will get multiple Regalia First credit card benefits like international lounge access, dining benefits, insurance coverage, etc. at a comparatively lower annual fee when compared to the Regalia card by HDFC. This card is a premium card but within budget.

On the other hand, the HDFC Millennia credit card is a perfect choice for those who are looking to spend less but get good rewards. If you are a frequent online shopper and travel domestically a lot, then this card is a good choice. You can access many benefits and rewards in terms of cash points that you will get after using a credit card for expenses.

This is a perfect card that will meet young generations’ requirements like frequently traveling, online shopping, dining out, etc. This card is also a full digital contactless card for online and offline payments.

Therefore, when one asks about HDFC Millennia credit card vs Regalia First which is better, the simple answer is; that HDFC Regalia First is more of a premium card that is targeted towards the middle-aged generation, whereas, Millennia is more of a young age millennial card with low-income slab eligibility and more rewards.