If you have ever invested money in the stock market or even in bank schemes, a CAGR calculator would be a very familiar term to you. It stands for Compound Annual Growth Rate (CAGR) and is a very useful formula in the banking and investment markets. It stands for one of the most precise techniques to figure out returns for specific assets, investment portfolios and anything else whose value might change over time. In this article, we will learn about the reverse CAGR calculator, CAGR calculator excel, CAGR calculator monthly, SIP CAGR calculator and other related terms.

Table of Contents

What is Reverse CAGR Calculator?

Before we learn about Reverse CAGR, it is important to understand the concept of CAGR and what it means in the world of investments. Once you familiarize yourself with some terms then you will get the CAGR calculations in a better way. Let us begin.

What is CAGR?

The term CAGR, which is the abbreviation for Compound Annual Growth Rate, describes the average yearly growth of an investment over a given time period. It is anticipated that the investment’s value will increase over time. In other words, it is a pro forma number that shows what an investment yields on a compounded basis, enabling investors to know what they will have after a certain period of time.

In contrast to absolute return, CAGR accounts for the time value of money. Because of this, it may represent the real profits of an investment made over a year.

For example, you invested Rs. 1000 in 2021 and it became Rs. 4000 by the end of the bullish year. This makes your profit 300%. In 2022, the market showed a correction and you lost 50% of the outstanding amount. As a result, you have Rs. 2000 left over after 2022.

Based on the Average Annual Return, you will find 175% growth in the investment over these two years. Therefore, since a 300% profit and a 50% loss give a 175% average, the annual return for these two years would be Rs. 3500. But, the resultant is Rs. 1750. This is why we need CAGR to calculate the growth accurately in an invested cap. It aids in overcoming the arithmetic average return’s shortcomings.

The best formula for comparing the performance of various investments over time is the CAGR. Investors can assess a stock’s performance against other stocks in a peer group or against a market index by comparing the CAGR. The historical returns of stocks to bonds or a savings account can also be contrasted using the CAGR.

What is CAGR Calculator?

A CAGR calculator is used to calculate the compound annual growth rate of an investment over time. A CAGR calculation requires you to enter the initial investment value, the expected final investment value, and the number of years.

The CAGR calculator provides a formula box for you to enter the investment’s starting and ending values. Additionally, you must specify the investment period. Therefore, the CAGR calculator shows you your investment’s annual growth rate. CAGR is a good way to compare returns on investments.

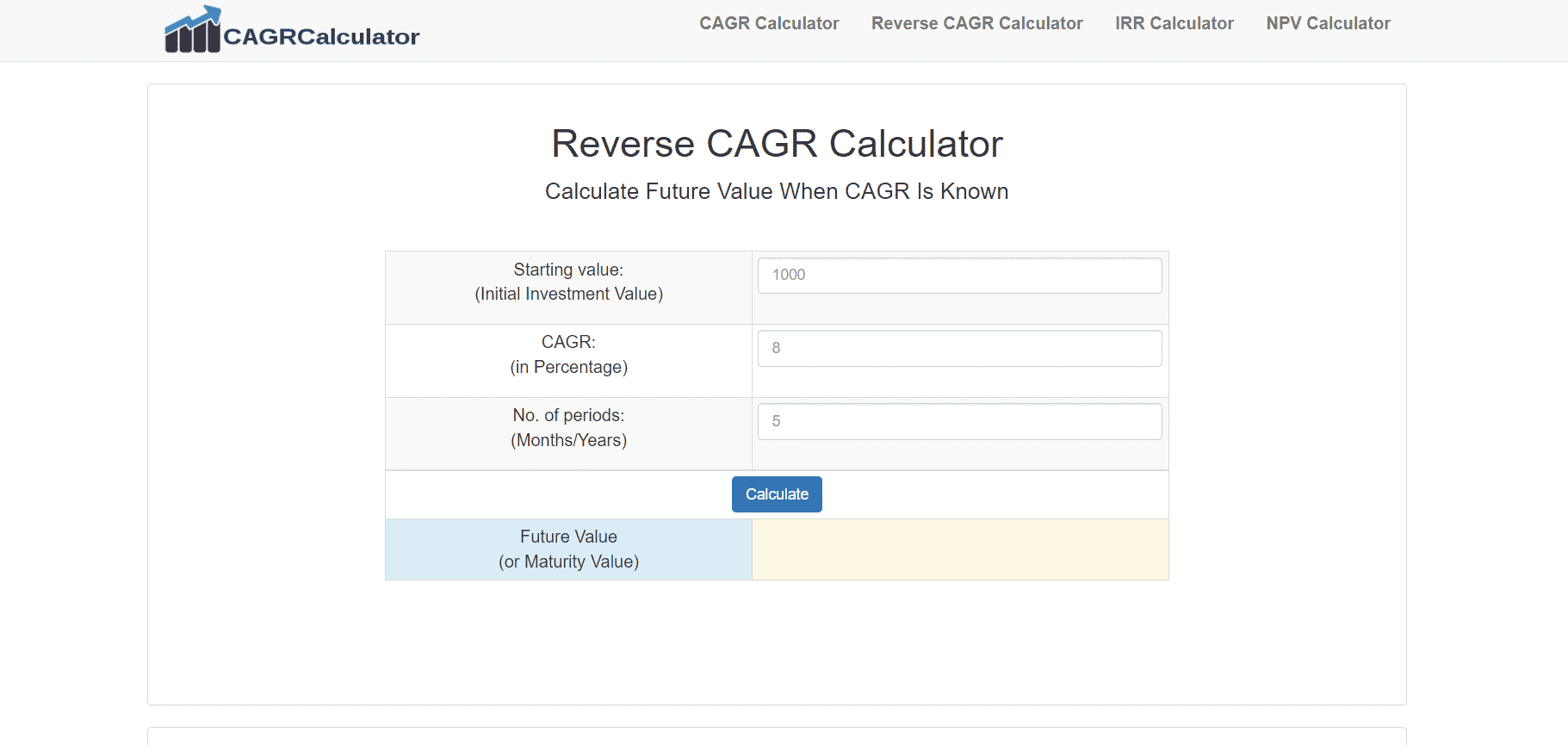

What is Reverse CAGR Calculator?

Reverse CAGR Calculator can be used to determine an investment’s future value, which is also known as the maturity value when the CAGR is already known. The eventual value of an investment is estimated using a reverse CAGR calculator. Starting price, compound return that has been guaranteed to you or that you expect, number of years you want to allow the investment to develop, and starting value.

You can use any online calculator that performs as Reverse CAGR Calculator. Simply enter the initial investment amount, CAGR, and the time period to compute the investment’s ultimate value or maturity value.

How does CAGR Calculator work?

The CAGR is calculated by taking the total return’s Nth root, where N is the length of time the investment was held. There are three components to the formula as below:

CAGR = [(Ending Value/Beginning Value) (1/N) – 1]

Here we have,

- Beginning value = The amount you started investment with

- Ending value = The resulting amount after the total investing period

- N = Number of years of the investment period

In the example used above, you use the square root of 175% (the total return for the period) to get a CAGR of 87.5% because your investment lasted for two years.

Also Read: How to Check Credit Score Online?

Benefits of using CAGR Calculator

You can use the CAGR calculator to estimate the yearly rate of return on your assets. You can evaluate your investment choices by comparing the investment’s returns to a pertinent standard.

- An easy-to-use utility tool is the CAGR Calculator. You only need to input the beginning and ultimate values as well as the investment duration. The compound annual growth rate will be displayed by the calculator.

- The CAGR can be used to assess the performance of your portfolio’s investments over time.

- You can evaluate a company’s performance in relation to its competitors or the sector as a whole using the compound annual growth rate.

- The CAGR calculator can be used to calculate the returns on your mutual fund investments. A comparison can be used to compare the mutual fund’s average annual growth rate over time. It gives you the option to choose a mutual fund based on past performance.

How to use CAGR Calculator in Excel?

CAGR is one of the most commonly used financial tools for assessing an investment over time. By using our online CAGR Calculator, you can quickly obtain the CAGR number with a detailed table report and chart images.

If you don’t have access to the internet, you can still compute the CAGR using Microsoft Excel. The Linux equivalent of Excel is LibreOffice Calc or OpenOffice Calc.

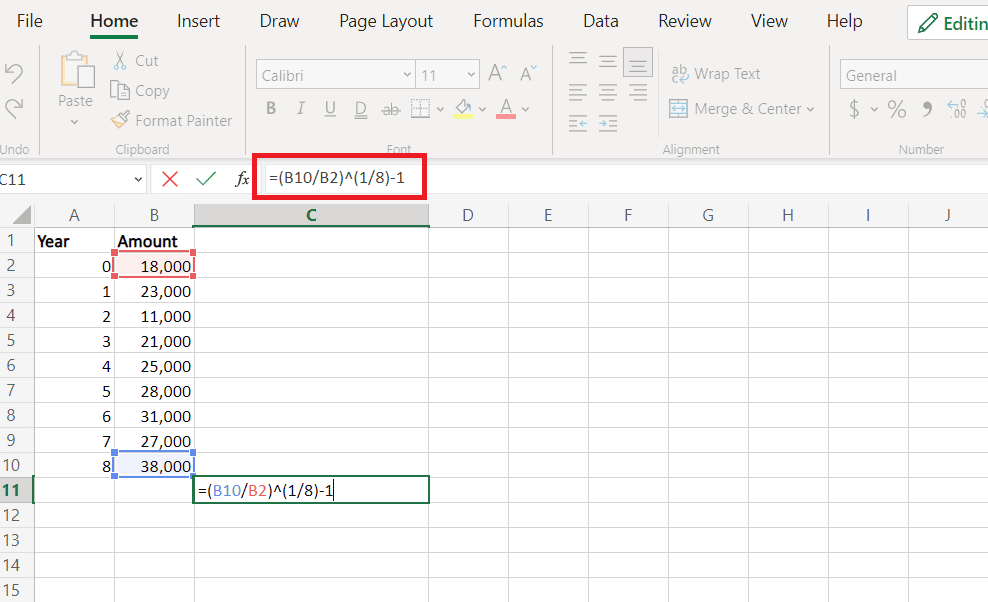

The Excel XIRR function can be used to compute CAGR in the case of singular data. The same formula can be used in Excel functions to calculate the CAGR value for an array of data. Let’s take a look at the steps once:

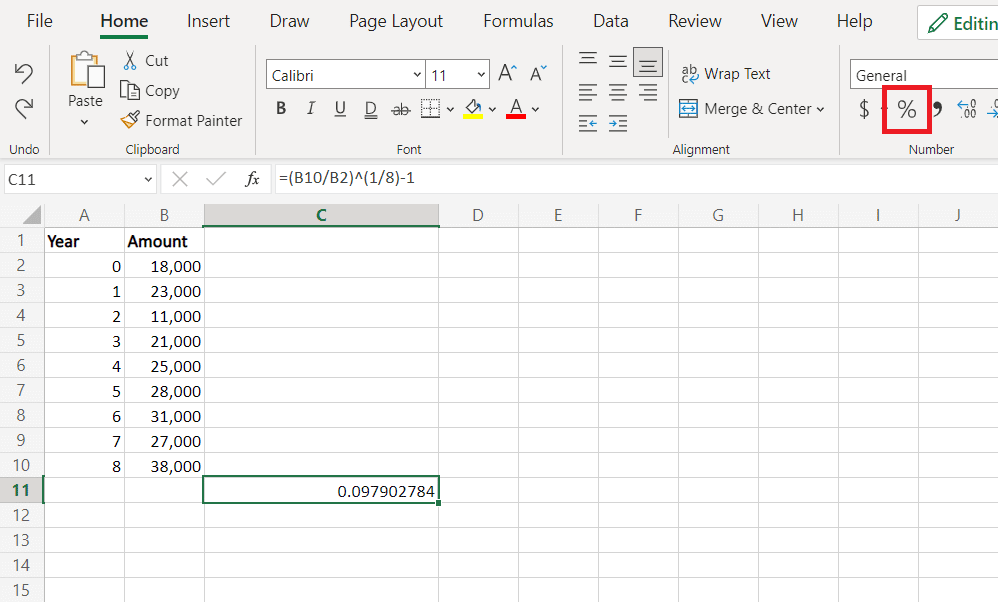

1. Take two columns to make an array of the data you have. The first column should be Year and the second column should be Amount.

2. Suppose columns A and B are occupied from cells 2 to 10. So, this makes the data in cells B2 to B10 the total amount invested. Since the year you invested money would be year 0, we have 8 years of investment.

3. Simply choose any cell in the ‘C column’ of your Excel sheet and then enter this formula = (B10/B2)^(1/8)-1.

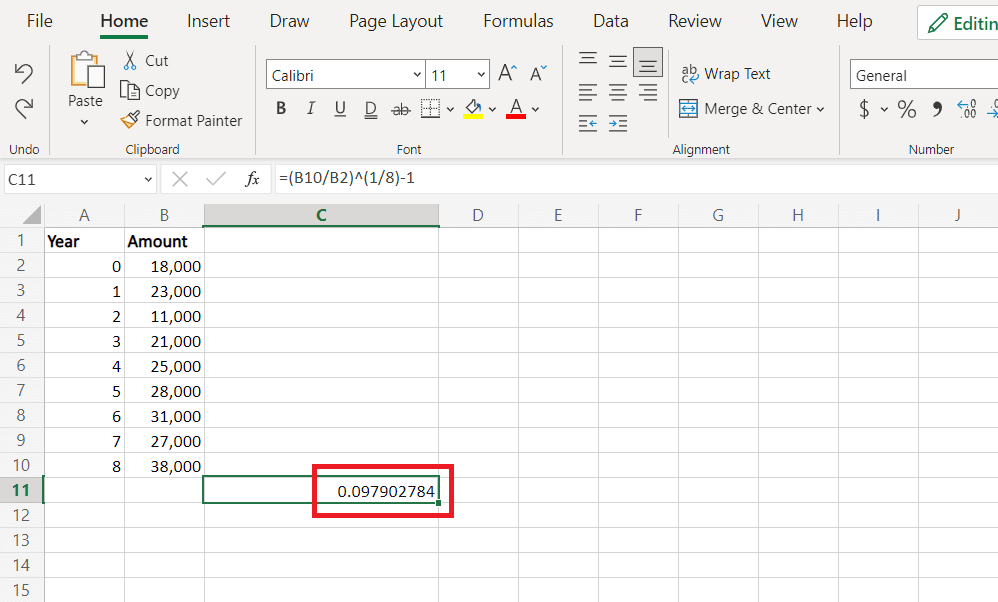

4. Hit Enter and you will get CAGR value in that cell.

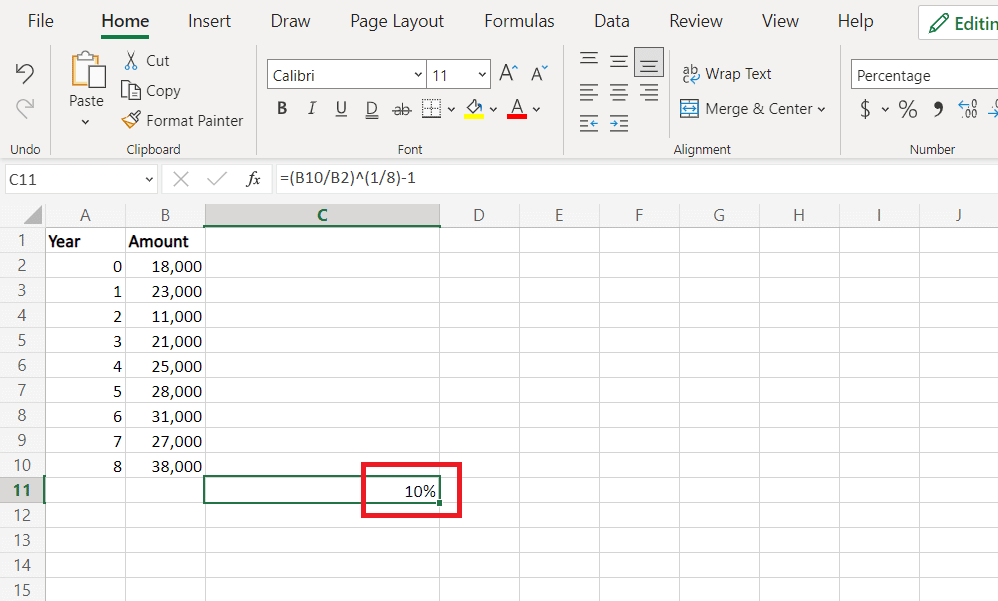

5. CAGR value generated will be in decimal but for financial terms, we need a percentage answer. To do that go to menu panel, and select the ‘%‘ icon to convert it.

6. After clicking on ‘%‘ icon, you will notice that the CAGR value has converted into percentage.

What are the Limitations of Reverse CAGR Calculator?

There are some limitations to CAGR, even though it is a useful concept. Some of them are mentioned below:

- The beginning and ending values are the only ones considered in CAGR calculations. It makes the assumption that growth will remain constant over time and does not take volatility into account.

- The inherent risk of an investment is not taken into consideration by CAGR. CAGR is not as significant as risk-adjusted returns when it comes to equity investments. To calculate the investment’s risk-return ratio, you must use Treynor’s and Sharpe’s ratios.

- It is only appropriate for a single lump sum investment. In the case of SIP investments, the systematic investment at various time intervals is not taken into consideration because only the starting amount is used to calculate CAGR.

How to Calculate Monthly Income on CAGR Calculator?

Let us now focus on CAGR Calculator monthly. As with a CAGR, you can view the annual percentage growth rate from the purchase price to the current price. There is a CMGR that does the monthly calculations too and works as CAGR Calculator monthly. Investors and resellers who keep shares for a brief length of time can find CMGR to be very helpful.

Additionally, it enables you to assess the book value of the sets you now own as of the most recent month. Simply compare your starting point to the price on the market right now. By first deducting fees and transaction charges from the current market price, you can even account for them. You will then get a current, accurate picture of how your financial portfolio is performing.

The formula remains the same except N would be the number of months of investment. You can also derive the CAGR value from CMGR like this:

- CAGR = [(CMGR + 1) 12 -1]

Then divide the obtained value by 100 to get a percentage. You now know about CAGR calculator monthly.

Also Read: What is NSE IFSC?

What is SIP CAGR Calculator? How does it work?

You can think about estimating the CAGR of your mutual fund SIP investments. The effects of volatility on recurring investments are eliminated by CAGR. The function XIRR can be used to account for various investments made in the same SIP over a specific term. By considering the investment duration, CAGR removes the restriction of the Absolute Method for computing SIP returns. It treats a number of SIPs as one investment.

Let’s use an example to clarify CAGR in SIP. Consider beginning a 12-month SIP in a mutual fund program with a contribution of Rs 500. At maturity, you received Rs. 6,500. The CAGR can be calculated as 15.67%.

CAGR is a useful and effective tool for assessing investment possibilities, but it does not provide the full picture. By evaluating their CAGRs across comparable time periods, investors can compare different investment options. In some cases, it can be highly useful.

We hope you know have a clear understanding of the reverse CAGR calculator, CAGR calculator excel, CAGR calculator monthly, and SIP CAGR calculator. CAGR is an important concept to understand if you are planning to invest in a competitive market. Investing can be tricky and learning about terms like CAGR will only help you master it.