As one of the world’s leading technology companies, Apple has been expanding its reach into various industries, including finance. In 2021, Apple announced its plans to launch an Apple Savings Account and it was finally released on 17th April 2023. Many people are now curious about how this new savings account stacks up against traditional savings accounts. In this article, we will compare Apple Savings Account vs others popular savings accounts available in the market.

Table of Contents

Apple Savings Account vs Others – Full Comparison

This exciting development has sparked a buzz in the finance community, with many savers considering this new option as a potentially lucrative alternative to traditional savings accounts. So, let’s take a deep dive study to find out where does Apple Savings Account rank and is Apple’s high yield savings account worth it?

To gain a quick understanding between Apple savings account vs others, read this data in a tabular form.

| Savings Account Name | Interest Rate | Minimum Deposit | Transfer/ Withdrawal Limit | Monthly Service Fee | Free ATM/ Debit Card |

| UFB Premier Savings | 4.81% | No minimum deposit | $30,000 per day | $0 | Yes |

| Bask Bank Interest Savings Account | 4.65% | No minimum deposit | 6 free withdrawals or transfers | $0 | No |

| Salem Five Direct eOne Savings | 4.61% | No minimum deposit | 20 | $0 | ____ |

| Bread Savings High-Yield Savings Account | 4.50% | $100 minimum opening deposit | 6 free withdrawals or transfers | $0 | No |

| CIT Bank Savings Connect Account | 4.50% | $100 minimum opening deposit | 6 free withdrawals or transfers | $0 | No |

| TAB High-Yield Savings Account | 4.40% | No minimum deposit | No limit | $0 | ____ |

| LendingClub High-Yield Savings Account | 4.25% | No minimum deposit | None | $0 | Yes |

| Apple Savings Account | 4.15% | No minimum deposit | $20,000 per week | $0 | No |

| Ally High-Yield Savings Account | 3.75% | No minimum deposit | None | $0 | No |

Cross-reference: Here are 8 interest savings accounts offering 5% APY

Now that you have a basic idea, let’s compare Apple Savings Account vs 8 other banks operating in the US.

1. UFB Premier Savings

The UFB Premier Savings Account offers up to 4.81% APY, no fees or minimum deposit, a free ATM card, digital banking tools, and free direct deposit transfers. It’s a flexible and affordable option for those looking to earn interest on savings.

2. Bask Interest Savings Account

Bask Bank Interest Savings Account offers up to 4.75% APY, no maintenance or service fees, and no minimum balance requirements. However, the account may be closed if left unfunded for 15 days.

The bank provides digital tools for remote banking, and free transfers between direct deposit accounts, but no ATM or debit cards.

Also Read: How to Buy Apple Shares in India?

3. Salem Five Direct eOne Savings

With no minimum balance or monthly fees, the Salem Five Direct eOne Savings account offers an industry-leading 4.61% APY rate and $250,000 FDIC insurance.

The account provides digital tools such as mobile banking, text alerts, and external transfers to make saving easy and convenient.

4. Bread Savings High-Yield Savings Account

The Bread Savings High-Yield Savings Account offers a competitive 4.65% APY2 with just a $100 minimum opening deposit. FDIC-insured up to $250,000, it has a maximum deposit limit of $1 million per account and $10 million limit per customer.

There are no hidden fees, and free ACH transfers, online statements, and incoming wire transfers make it easy to manage your money.

5. CIT Bank Savings Connect Account

The CIT Bank Savings Connect Account offers a high interest rate of over 11x the national average, along with digital convenience through online banking and a mobile app.

With easy account opening and FDIC insurance, it’s a smart choice for growing your savings quickly and securely.

6. TAB High-Yield Savings Account

The TAB High-Yield Savings Account is a great option for savers, offering a 4.40% APY, no balance caps or monthly fees, and no minimum deposit required.

With online and mobile banking access and FDIC insurance, it’s a convenient and secure way to grow your savings.

7. LendingClub High-Yield Savings Account

The LendingClub High-Yield Savings Account offers a competitive 4.25% APY on your entire balance and freedom from fees, including no monthly service fees and no minimum balance requirement after an initial $100 deposit.

With a free ATM card, it’s a convenient and cost-effective way to grow your savings. Its APY comes the closest to Apple savings account comparison.

8. Apple Savings Account

Apple savings Account interest rate is 4.15% which is quite impressive even though not the best. If we estimate Apple Savings Account rank among the other high-yielding savings accounts, it will come in at around 7th or 8th rank. But this solely depends on user discretion as someone already using Apple card would find it much higher in rank as compared to others.

Recommended: Can You Get CashBack With Apple Pay?

9. Ally High-Yield Savings Account

The Ally High-Yield Savings Account offers a high-interest rate of 3.75%, with no fees or minimums required. Additionally, 24/7 support is available, providing peace of mind knowing that help is always there when you need it.

What do you Need to Open Apple Savings Account?

Since the scheme has been launched for US citizens only hence, the preliminary requirement for the same is that you should be an adult with a physical US residence.

- You should have an active Apple Card account with Apple Card added to your iPhone wallet.

- You need to have your iPhone updated to the latest version of iOS.

- Additionally, you need to set up two-factor authentication for your Apple ID for safety reasons, of course.

If you do not have an Apple Card, you can apply & set it up here.

How to Set up Apple Savings Account?

You can easily set up Apple Savings Account via Apple Wallet & Apple Card settings as follows:

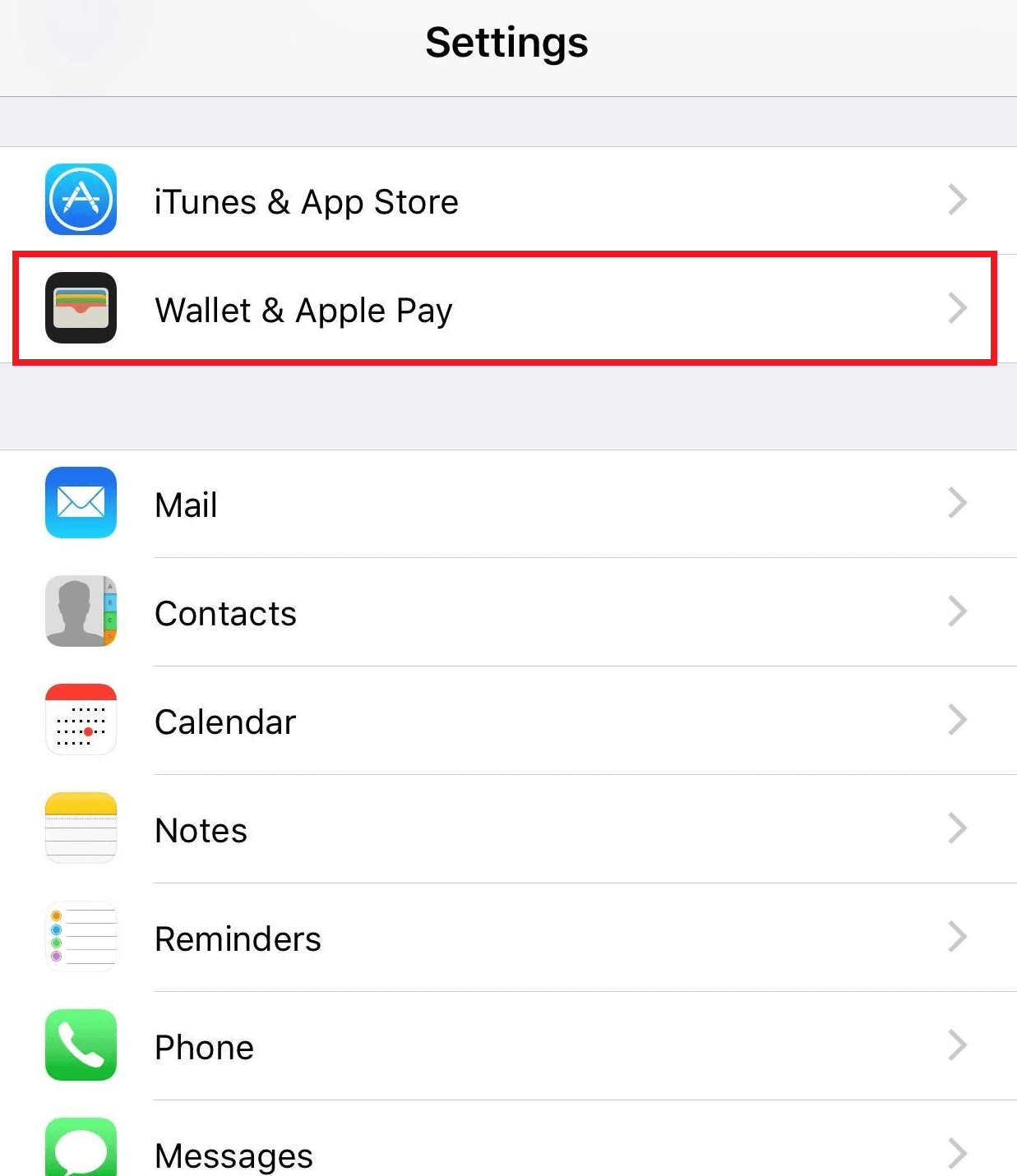

1. Launch the iPhone Settings. Tap on Wallet & Apple Pay option.

2. Next, tap Apple Card added to the account and then, More button.

3. Choose Set Up option for Savings Account & follow the on-screen instructions as displayed.

Is Apple’s High Yield Savings Account Worth It?

The new high-yield savings account offered by Apple seems like a great opportunity to earn an impressive 4.15% APY without any monthly fees or minimum deposits. Furthermore, the Daily Cash rewards earned with an Apple Card can be conveniently deposited into this account.

However, financial experts advise that there are other comparable or even better high-yield savings accounts available in the market, and it’s essential to conduct personal research to find an account that suits individual financial needs.

There are many accounts providing a higher rate than Apple’s account, as we have already seen. Only one comes anywhere near Apple savings account comparison, and one offers a lower rate than it.

While high-yield savings accounts are generally secure and lucrative, it’s crucial to evaluate one’s unique financial situation and goals before making a decision. Ultimately, the most beneficial savings account is the one that helps reach individual financial objectives.

Source: Apple Newsroom, Apple support