If you are thinking of earning profits and maintain excellent credit scores, Charles Schwab Investor Card is perfect for you. With a wide range of rewards and user-friendly service, it helps manage investments by providing access to exclusive financial tools. In this article, we will explore the key aspects of the Charles Schwab Investor Card, shedding light on its eligibility, fees, and benefits.

What is Charles Schwab?

The Charles Schwab Corporation is a multinational financial services company based in the United States. It provides a range of financial services, including banking, commercial banking, investment services, and related consulting and wealth management advisory services. The company serves both retail and institutional clients, operating through over 400 branches primarily located in financial centers in the United States and the United Kingdom. It holds the tenth position on the list of the largest banks in the United States based on assets.

Established in 1971 by Charles R. Schwab as Charles Schwab & Co., the company took advantage of the financial deregulation in the 1970s to become a pioneer in the discount sales of equity securities. Beginning with its flagship location in Sacramento, the bank expanded its presence to Seattle. During the economic expansion of the 1980s, the bank invested in technology, automation, and digital record-keeping. Charles Schwab was the first to introduce round-the-clock order entry and quotation services. In 1983, Bank of America acquired the company for $55 million.

Table of Contents

All About Charles Schwab Investor Card

When you’re exploring credit card options, it’s crucial to discover one that aligns with your lifestyle and spending patterns. The Schwab Investor Card by American Express might be a great choice if you’re looking to combine cashback rewards with your Schwab investment account.

In this review of the Schwab Investor Card from American Express, we’ll delve into the pros and cons of the card, as well as the ins and outs of earning and redeeming cash back. This information will aid you in determining whether the Schwab Investor Card from American Express is a suitable addition to your wallet.

Features of Charles Schwab Investor Card

The Schwab Investor Card from American Express proves to be an excellent choice for those seeking a high-quality cashback rewards card that contributes to the growth of their Schwab investment account. With this card, you can effortlessly earn cash back on all your purchases, and the rewards are conveniently deposited directly into your linked Schwab account. This means that your everyday expenses can actively contribute to the growth of your investments.

- Introductory 0% APR: For the first 6 months, new cardholders enjoy a special 0% APR on their initial purchases.

- Competitive APR Range: The Schwab Investor Card from American Express offers a variable purchase APR, spanning from 14.74% to 17.74%.

- No Annual Fee Convenience: Ideal for those seeking a hassle-free rewards card, this option provides rewards on purchases without the burden of an annual fee.

- Foreign Transaction Fee Alert: When traveling abroad, it’s advisable to steer clear of using this card, as it imposes a 2.7% commission on every transaction outside the U.S.

- Credit Score Requirement: Approval odds are higher for individuals with a credit score of 700 or above; a lower score may diminish your chances.

- Welcome Bonus: Get a generous welcome offer with a $200 cash back reward (provided as a statement credit) after spending $1,000 within the first 3 months of opening your account.

- Unlimited Cash Back: Enjoy unlimited 1.5% cash back on all qualifying purchases, giving you a consistent way to earn rewards.

- Exclusive Schwab Partnership: Experience a distinctive partnership where all your earned cash back is seamlessly deposited into your linked Schwab account, providing a convenient way to boost your investments.

- ShopRunner Membership: Access a complimentary ShopRunner membership for free shipping on eligible purchases from over 100 online retailers. Enjoy speedy shipping, often within two days, from major brands like Under Armour, 1-800-Flowers, Neiman Marcus, and more. This membership requires enrollment and also offers free return shipping through ShopRunner.

- Car Rental Loss and Damage Insurance: Benefit from up to $50,000 in insurance coverage for damage or theft of an eligible rental vehicle. Cardmembers, their spouses or domestic partners, and authorized drivers are all covered under this valuable feature.

- Extended Warranty Benefits: Qualifying purchases receive an additional year of extended warranty coverage, with a maximum of $10,000 per eligible purchase and up to $50,000 per card account.

- Purchase Protection: Gain peace of mind with purchase protection that covers eligible purchases for damage or theft within 90 days of purchase. This feature provides coverage up to $1,000 per eligible purchase and up to $50,000 per card account.

Rewards Offered by Charles Schwab

Let’s explore how the Schwab Investor Card from American Express can contribute to your cash back over the years.

- In the first year, you could potentially earn $703, which includes statement credits and deposits into your Schwab account.

- Moving on to the second year, you might see earnings of $503, primarily in the form of Schwab deposits.

- To make the most of the cashback rewards offered by the Schwab Investor Card, it’s advisable to use it for a wide range of purchases.

- The card provides a consistent 1.5% cash back on all eligible transactions, eliminating the need to focus on specific categories like groceries or gas.

- Essentially, every purchase you make can contribute to a 1.5% cash back return.

When it comes to redeeming your cash back, it’s worth noting that the funds are automatically transferred to your linked Schwab account. Given that this is the sole redemption option, maximizing your cash back becomes key to increasing the deposits into your investment account.

How to apply for Charles Schwab Investor Card?

Step 1: Go to the Charles Schwab Investor Card from American Express website and click on Apply Now.

Step 2: Complete the application form, where you’ll be asked for basic financial details like your Social Security Number, address, and annual income.

Step 3: Double-check that all the information is correct before submitting your application.

Who are Eligible to Apply?

If you’re 18 or older, living in the U.S. (including its territories and Puerto Rico), and have a valid U.S. home address, you can apply for a Card account if you have an eligible Schwab account.

An eligible account refers to either a Schwab One or Schwab General Brokerage Account under your name or the name of a revocable living trust where you serve as the grantor and trustee, or a Schwab Traditional, Roth, or Rollover IRA that is not under the management of an independent investment advisor through a direct contractual relationship between you and the advisor.

If you don’t already have an eligible Schwab account, you can open one at Schwab One or by calling 866-385-1227.

Required Credit Score

To qualify for the Charles Schwab Investor Card, it’s usually important to have a solid credit score. Although the specific criteria can differ, it’s generally advised to aim for a credit score of 700 or higher to enhance your likelihood of being approved. Nevertheless, simply meeting the credit score benchmark doesn’t assure approval, as the application process takes into account additional factors like income and current debts.

Also Read: How Short-term Loans affect your Credit Score?

Charles Schwab Investor Card Fees

Opening a Charles Schwab brokerage account, individual retirement account (IRA) account, Schwab Trading Services account, or Schwab checking account linked to a Schwab One brokerage account is completely free. There are no fees for opening or maintaining these accounts, and there are no account minimums to worry about.

Schwab Investor Card from American Express is a great option for those seeking a rewards card without an annual fee. It doesn’t impose overlimit fees, offering a hassle-free experience. However, it’s important to note that the card does come with a 2.7% foreign transaction fee. For instance, if you spend $2,000 on a week-long vacation abroad, you’ll incur a $54 foreign transaction fee. If you frequently travel internationally, you might want to consider applying for a card that doesn’t charge foreign transaction fees and leave this one at home.

| Description | Applicable Fee |

| Cash Advance Fee Minimum | $10 |

| Cash Advance Fee (%) | 5% |

| Minimum Cash Advance Fee ($) | $10 |

| Foreign Currency Transaction Fee | 2.7% |

| Annual Fee | 0 |

| Annual Fee | $0 |

| Over-Limit Fee | $0 |

| No Interest Grace Period for Late Payment | 25 days |

| Returned Payment Fee | $40 |

| Late Fee Amount | $40 |

Who is Charles Schwab Investor Card Best for?

The top-notch rewards credit cards provide points, miles, or cash back on your purchases. The Schwab Investor Card from American Express falls into the cash back category, allowing you to earn rewards effortlessly on eligible purchases.

It’s important to note that the Schwab Investor Card is tailored for those who specifically want to accumulate cash back with the intention of depositing it into a Schwab account. This card limits its redemption options to this sole purpose. If you don’t have a Schwab investment account or don’t plan to open one, this card might not align with your preferences.

Charles Schwab Investor Card Pros

- Enjoy potentially lower than average APRs on your purchases.

- Benefit from a 0% APR on new purchases for the initial 6 months, followed by a variable purchase APR ranging from 14.74% to 17.74%.

- No need to worry about an annual fee.

- Stay secure with Identity Theft Protection.

- Earn rewards on your purchases as a cardholder.

- The Schwab Investor Card from American Express reports to multiple credit bureaus, helping you build and track your credit history.

Charles Schwab Investor Card Cons

- Having a solid credit history is necessary for eligibility.

- Unfortunately, there is no signup bonus available.

- Be aware of a 2.7% fee for foreign transactions.

- Rewards are not earned on every purchase.

Is Charles Schwab Investor Card Safe?

When considering applying for a new credit card, Charles Schwab Investor Card emerges as a safe bet. Unlike some other banks, Amex typically refrains from performing a hard pull on your credit report when denying an application. Even if you already hold a Charles Schwab card, the likelihood of encountering a hard pull upon approval for another one is generally low. Additionally, it has implemented a beneficial feature during the application process: they now provide a warning if you don’t meet the eligibility criteria for the bonus, offering transparency to potential cardholders.

- Lifetime Rule: If you’ve had the same card in the past, chances are you won’t be eligible for a welcome bonus if you apply for it again. Luckily, the application process will notify you if this restriction applies. Amex tends to overlook your card history after approximately 7 years.

- 90 Day Rule: You’re limited to obtaining a maximum of two credit cards within a 90-day period. It’s important to note that this rule doesn’t apply to Pay Over Time (charge) cards.

- 5 Credit Card Limit: Amex typically won’t approve new credit card applications if you already have five or more Amex credit cards, or if you hold 10 or more charge cards.

Does Charles Schwab Investor Card Report you to Credit Bureaus?

The Schwab Investor Card from American Express shares your account activity with major credit reporting agencies:

Consistently making timely payments to a creditor that reports to these credit bureaus reflects your financial responsibility and could positively impact your credit score.

Alternatives to Charles Schwab Investor Card

The Schwab Investor Card from American Express caters well to those with Schwab investment accounts, but it might not be the ideal choice for everyone. If you’re seeking higher earning potential, exploring some of the top cashback credit cards could be worthwhile.

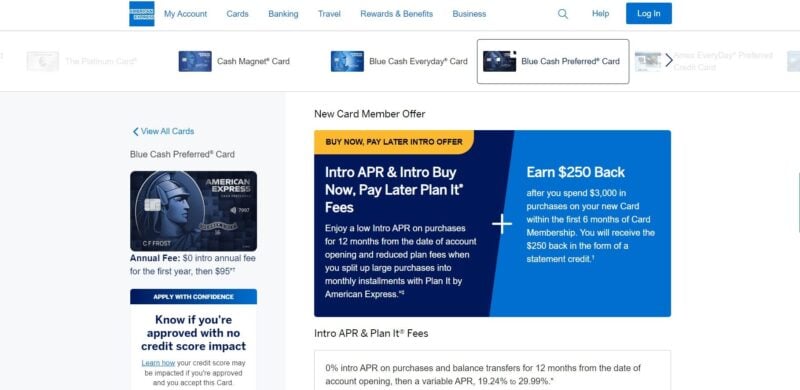

1. Blue Cash Preferred Card from American Express

It comes with a $0 intro annual fee for the first year, and $95 per year thereafter (See rates and fees). The card allows you to earn 6% cash back at U.S. supermarkets (on the first $6,000 per year, then 1%) and on select U.S. streaming services.

Additionally, you get 3% cash back at U.S. gas stations and on eligible transit, along with 1% cash back on other eligible purchases. Given its attractive rates in common spending categories, the Amex Blue Cash Preferred has the potential to outshine the earning capabilities of the Schwab Investor Card.

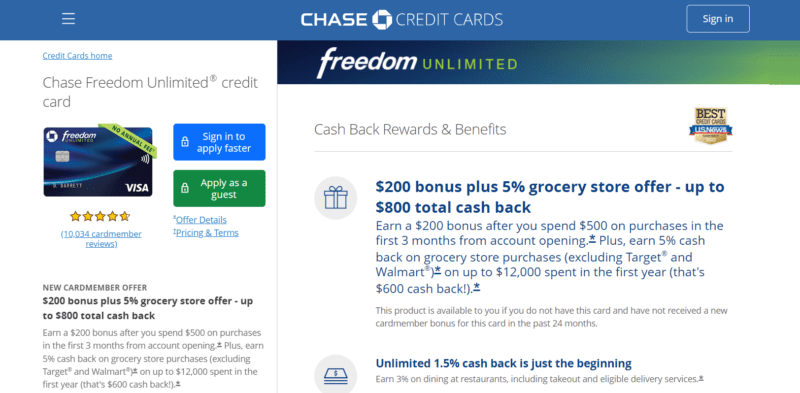

2. Chase Freedom Unlimited

This card lets you earn 5% cash back on travel purchased through Chase Ultimate Rewards, 3% cash back on drugstore purchases and dining at restaurants (including takeout and eligible delivery services), and a solid 1.5% cash back on all other purchases.

Across all earning categories, the Freedom Unlimited either matches or exceeds the benefits of the Schwab Investor Card. Notably, the cash back earned with this card comes in the form of Chase Ultimate Rewards points, providing flexibility in redemption options, including cash back, online shopping, gift cards, and travel.

Also Read: Slice Credit Card Review – Features and Benefits

Charles Schwab Investor Card offers various features to simplify the financial journey for its users. It is a viable option for those seeking a practical and cost-effective option for navigating the world of investment.