Entering your 40s marks a pivotal phase in your financial journey, characterized by greater financial stability and a clearer understanding of long-term goals. It offers unique opportunities to utilize your experience and skills to obtain a clearer perspective on your priorities. Getting through this decade with informed choices can significantly secure your financial future and achieve the lifestyle you desire.

Table of Contents

How to Build Wealth in Your 40s

Your 40s present an opportune moment to initiate the process of accumulating wealth. This phase aligns with your highest-earning years, and despite potentially increased financial responsibilities, you likely possess funds allocated in retirement plans and diverse investments. Here are strategies to foster wealth development during your 40s, accompanied by suggestions for establishing consistent financial inflow that extends into your retirement years.

1. Evaluate Your Current Financial Status

Assessing your financial standing before knowing how to build wealth in your 40s is pivotal. This process encompasses evaluating your net worth by subtracting liabilities from assets. Assets encompass property, investments, savings, and valuables, while liabilities comprise mortgages, loans, credit card debt, and other financial obligations. Understanding your net worth facilitates grasping your present financial status and establishing pragmatic financial objectives.

Scrutinizing income and expenses include calculating your monthly earnings and expenses, that will aid in pinpointing avenues to curtail expenses and boost savings. Drafting a budget and closely monitoring expenses can help you discern where cutbacks are feasible. Common areas for expense reduction include dining out, entertainment, and subscription services.

Once potential cost-cutting zones are identified, reallocating those funds toward savings and investments becomes feasible. This holistic process of financial evaluation and strategic planning underpins effective wealth-building in your 40s. This is one of the best ways to build long term wealth.

2. Define Financial Objectives

Setting financial objectives is crucial as they provide direction and motivation for achieving financial success. These should encompass both short-term and long-term objectives, with a focus on prioritization and a well-defined strategy. Effective prioritization of these goals ensures that you concentrate your efforts on the most significant and attainable ones initially.

Short-term financial objectives typically span one to three years and may involve tasks such as building an emergency fund, eliminating credit card debt, or funding a vacation. In contrast, long-term goals extend over five years or more and can include objectives like retirement planning, property acquisition, or initiating a business venture.

Constructing a comprehensive plan to achieve your financial targets requires breaking down each goal into actionable steps. A well-structured plan not only aids in monitoring your progress but also allows for necessary adjustments along the way. This iterative approach ensures that you remain on track and can adapt to changing circumstances. Now you know why building wealth is important and how you can do it.

3. Reduce Daily Expenditures

As you enter this stage and want to learn how to build wealth in your 40s, it’s probable that your income is higher than ever before. However, it’s essential to resist the temptation of letting these increased pay checks lead to inflated lifestyle choices. Although the allure of a larger house, new vehicles, or extravagant vacations may be strong, it could be a prudent decision to exercise restraint in your spending habits during this period.

Every dollar saved during your 40s holds the potential to magnify your financial flexibility during retirement. This is especially crucial if you initiated your savings journey later in life. By maintaining a disciplined approach to spending and boosting your savings, you can significantly reduce the risk of your retirement fund falling short when the time comes.

If you’re still contending with debts at this stage, it would be prudent to prioritize the elimination of those financial obligations. Exploring options such as mortgage or student loan refinancing, along with consolidating high-interest credit card debt, might accelerate the debt repayment process, thereby reducing your monthly financial burdens.

4. Resist Lifestyle Inflation

It’s crucial to be cautious about succumbing to lifestyle inflation, as this can have a significant impact on your overall financial planning. While it’s certainly reasonable to enjoy certain luxuries such as a family vacation, it’s important not to fall into the trap of constantly increasing your spending to match external standards or keep up with others in your community. This approach can hinder your ability to save as effectively as you might desire during your 40s.

Balancing self-care and providing for your family is commendable, but it’s wise to do so thoughtfully and purposefully. Make sure that your spending aligns with your primary financial goals and aspirations. Allowing your expenses to spiral uncontrollably can have negative consequences for your financial stability and future plans. This is one of the best ways to build long term wealth.

Also Read: National Financial Awareness Day: Definition and Facts

5. Generate Passive Income Sources

To know how to build wealth in your 40s, create a variety of income sources. Relying solely on a single job can hinder your financial progress and expose you to risk. To counter this, focus on creating multiple revenue streams.

Passive income streams encompass endeavours that demand initial investments of both time and money, yet consistently generate earnings. Its advantage is twofold: it provides a safety net if one income stream falters and generates extra funds for saving and reinvestment. By broadening your earnings, you can also allocate resources to paying off debts, building retirement funds, and exploring further investment opportunities.

Venture into sideline businesses or freelance work that align with your skills and passions. Research potential investments such as stocks, bonds, and mutual funds. Additionally, the real estate market offers the potential for rental income. Your unique combination of interests and skills can guide you in establishing several income sources, enhancing your financial stability. A more substantial passive income translates to reduced pressure on your savings when your retirement phase commences.

6. Employ Strategic Investment Approaches

By the age of 40, investments become a significant aspect of most individuals’ lives. This is primarily due to the financial responsibilities that come with supporting families and households while being employed. Often, the earnings might appear insufficient to cope with the increasing expenses and contemporary demands.

In reality, many individuals sometimes either succumb to a lifestyle exceeding their financial means or encounter difficulties in meeting their financial obligations due to various factors. Establishing an investment strategy becomes crucial to ensure that the money you’ve worked hard for not only covers expenses sensibly but also gets invested in advantageous and rewarding ventures. This, in turn, provides a reliable financial cushion for the future.

It’s essential to assess your risk tolerance and subsequently identify suitable investment platforms. Among these, debt investments emerge as a highly viable choice due to their extensive variety. Constructing a portfolio that emphasizes diversity in performance is vital, achieved by maintaining a balanced blend of debt and equity investments. Now you know why building wealth is important and how you can do it.

7. Design a Budget

Many individuals often perceive a budget as a restrictive concept, but fundamentally, it serves as a blueprint for managing your finances. Just as putting your goals in writing enhances the likelihood of achieving them, having a budget significantly improves your chances of attaining your financial objectives. The cornerstone of any effective wealth accumulation strategy is a well-structured budget. Otherwise, there’s a risk of unknowingly overspending on various expenses, ranging from entertainment to essential utilities.

Engaging a financial advisor provides a valuable source of accountability. In the interim, it’s crucial to take a candid assessment of your monthly expenditures in relation to your contributions towards savings and investments. If you haven’t initiated savings by the age of 40, contemplating self-investment to enhance your earning potential could be worthwhile. Pursuing a new university degree or enrolling in courses might yield long-term benefits by expanding your income prospects and capacity to save.

Prioritizing your own financial well-being by setting up automatic transfers into a savings or investment account each payday, ahead of bill payments, simplifies the process of adhering to your budget and realizing your wealth accumulation aspirations. This is one of the best ways to build long term wealth.

8. Construct a Diverse Investment Portfolio

Numerous individuals, who want to learn how to build wealth in your 40s, possess investment portfolios heavily skewed towards high-tech growth stocks. Although stocks like Amazon and Facebook have shown remarkable performance over the years, it’s important to recognize that high-growth stocks can experience both upward and downward fluctuations.

While individuals in their 30s have the advantage of time to recover from investment blunders due to their longer investment horizon, those approaching their 40s and retirement might find it prudent to prioritize adequate diversification in their investment portfolios. This entails achieving a harmonious blend of securities across different categories, encompassing both small and large-cap companies, diverse economic sectors, and stocks that display low correlations with the broader market, such as real estate investment trusts (REITs).

Certain REITs exhibit a procyclical nature, thriving during periods of strong performance in the general stock market. Conversely, others follow a countercyclical pattern, demonstrating resilience even when overall stock market returns decline. Due to legal requirements, REITs are obligated to distribute 90% of their net income as dividends to shareholders. This characteristic makes owning a REIT as a potentially beneficial strategy to generate supplementary recurring income.

9. Opt for Index Fund Investments

You can direct your funds into index funds, encompassing stocks, bonds, and real estate, thereby facilitating investments across various sectors and industries. These funds are a subset of mutual funds, tailing specific indices like the S&P 500, and present an economical avenue to enhance portfolio diversity. The primary advantage lies in the stability and predictability index funds offer, making them especially appealing to those who shy away from high-risk ventures.

Furthermore, these funds typically boast lower expense ratios when juxtaposed with actively managed counterparts, ultimately yielding superior long-term returns. A key merit of index funds is their passive management approach, negating the necessity for constant vigilance and adjustment. This feature resonates particularly well with busy professionals who want to know how to build wealth in your 40s, sparing them the ordeal of hands-on portfolio management amid their hectic schedules.

However, it’s crucial to understand that index fund investment isn’t devoid of risk and warrants a prudent assessment of financial aspirations and risk tolerance. Adhering to a consistent review and rebalancing cadence is also vital to ensure alignment with overarching investment objectives.

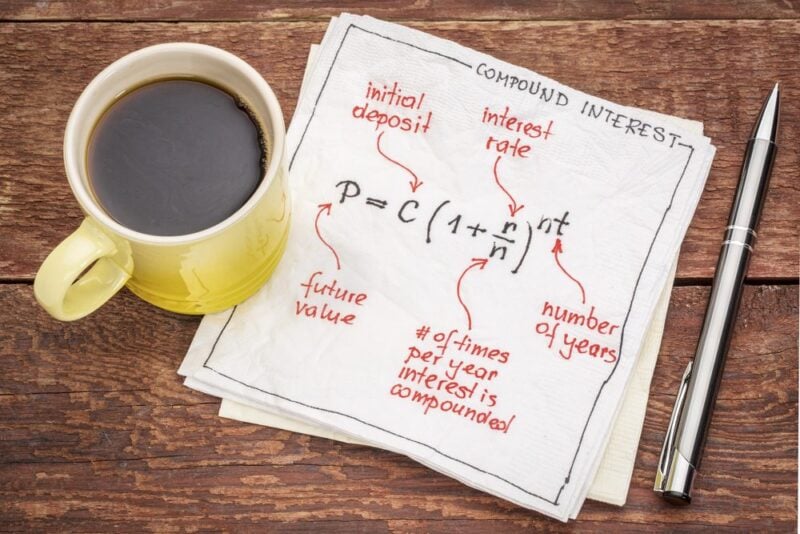

10. Grow Your Wealth through Compound Interest

Compound interest facilitates the accelerated growth of a sum of money compared to simple interest. This acceleration occurs because you not only earn returns on the initial investment but also on the accrued returns during each compounding period, whether that’s on a daily, monthly, quarterly, or annual basis. This mechanism propels the expansion of your wealth at an increased pace and reduces the necessity to set aside larger amounts of money to achieve your financial objectives.

The timeliness of your investment initiation plays a pivotal role in maximizing the benefits of compound interest. Irrespective of your chosen investment method, the crucial primary step is to establish at least one account and consistently contribute to it. This practice ensures that you harness the full potential of compound interest to your advantage. This is one of the best ways to build long term wealth.

11. Create a Strategy to Manage Debts and Credits

In your 40s, it becomes essential to address a variety of financial responsibilities, including managing high-interest credit card debts, ongoing student loans, and personal loans. A strategy frequently utilized by real estate investors is referred to as the snowball strategy. This approach involves harnessing rental income to expand your portfolio of rental properties.

Embracing the snowball strategy for managing debt follows a structured methodology. Initiate the process by allocating a fixed sum of money every month towards reducing your debts. Your focus should be on paying off the debt with the smallest outstanding balance first. After successfully clearing that debt, in addition to the regular payments that were previously allocated to the now-settled loan, redirect the additional funds towards settling the next debt with the smallest balance. Repeat this cycle iteratively until you effectively eliminate all your outstanding debts. Now you know why building wealth is important and how you can do it.

12. Accelerate Mortgage Repayments

If you find yourself with the opportunity to refinance your current mortgage at a lower interest rate, it’s advisable to take action sooner rather than later. Interest rates are starting to increase after being at historically low levels, and the future remains uncertain. Conversely, if the prospect of refinancing doesn’t seem financially viable, an alternative approach is to boost your monthly mortgage payment amount. This additional payment can be allocated towards reducing the principal amount or making an extra payment.

For example, suppose you’ve recently bought a $300,000 home with a 30-year fixed-rate mortgage. By contributing just an extra $100 per month to your mortgage payments, you could effectively pay off the loan nearly 4 years ahead of schedule.

This information holds particular significance because entering retirement while still carrying mortgage debt typically isn’t a wise decision. Given that your monthly income during retirement is likely to be lower than what you earned while working, it’s preferable not to have the added burden of mortgage financial obligations during this phase of life.

13. Keep aside Retirement Savings

As you cross your 30s and want to learn how to build wealth in your 40s, it’s crucial to consider your financial strategies for a comfortable retirement. While loans may have assisted you in achieving specific financial milestones like purchasing a home or funding personal endeavours, it’s essential to recognize that relying on loans during retirement isn’t feasible.

During this phase of life, it’s advisable to evaluate your existing assets, such as company-sponsored retirement plans and any private savings you’ve initiated, aimed at securing your financial independence in retirement. If the idea of retirement planning hasn’t crossed your mind yet, there’s still ample time to establish a robust retirement fund. Exploring avenues like investing in stocks and mutual funds can potentially facilitate wealth accumulation over the long term.

Before delving into these investment choices, thorough research is a prudent approach. Familiarizing yourself with various options can prove beneficial. It’s worth noting that retirement accounts generate tax-free income until withdrawals commence, fostering exponential growth of your retirement savings. For added contributions, you might consider personal Individual Retirement Accounts (IRAs) or Roth IRAs, yet it’s advisable to consult a financial advisor beforehand to ensure adherence to Internal Revenue Service (IRS) regulations. This is one of the best ways to build long term wealth.

14. Explore Investments through Non-Retirement Portfolios

Investing outside of retirement holds significant importance due to federal rules that place limits on retirement savings within tax-advantaged accounts. When these restrictions are met, it becomes prudent to investigate alternative investment options. It’s wise to consider diversification through non-retirement accounts even before reaching the maximum contributions for retirement accounts.

Setting up a 529 plan for your children’s educational expenses stands as a shrewd choice, as it leverages tax advantages and the power of compounding to grow your wealth. As the costs of college tuition and fees continue to rise, having this account can help mitigate the stress of making future decisions about funding your children’s education.

15. Know about Superannuation Policies

In your 40s, it’s a crucial period to contemplate redirecting a portion of your income towards your superannuation fund. In many cases, tax rate of 15% applied to these additional contributions, known as concessional contributions, is lower than your standard marginal tax rate. This tactic can serve as an effective tax strategy, especially if your annual income exceeds $45,000. Now you know why building wealth is important and how you can do it.

It’s important to bear in mind that there are limitations on the amount you can contribute to your super annually. Make sure to verify the contribution cap for the specific year you intend to make extra contributions for. There are alternative methods to optimize your superannuation, including making contributions to your spouse’s super fund. Besides boosting your collective savings, this contribution can also function as a tax offset.

Furthermore, your 40s are an opportune time to reassess your superannuation investments. Some superannuation funds tend to adopt a more aggressive investment approach for younger individuals, gradually pivoting towards lower investment risk as members approach retirement age. This juncture presents a wise moment to evaluate your investment portfolio and determine whether you’d prefer a more daring or cautious stance regarding your superannuation investments.

16. Utilize Company-Provided Benefits

Numerous employers provide valuable benefits aimed at assisting you to grow your wealth. One prominent advantage is the 401(k)-matching feature, available in approximately 98% of 401(k) plans. This involves the employer matching a specific percentage of the contributions you put into your retirement account.

To illustrate, let’s consider a scenario where a company offers a 100% match on the first 6% of your salary. If your annual income is $100,000 and you contribute $6,000 to your 401(k), your employer would also contribute an additional $6,000. Seizing this opportunity is crucial if your employer extends this benefit.

Additionally, it’s important to optimize other perks your workplace provides for wealth accumulation. This could encompass benefits such as health insurance, a health savings account (HSA), and various other financially rewarding offerings. To gain a comprehensive understanding of all the benefits available to you, it’s recommended to liaise with your organization’s Human Resources department. This is one of the best ways to build long term wealth.

17. Plan a Mini Retirement

The evolving landscape of work has brought about a noteworthy trend among individuals who express an interest in knowing how to build wealth in your 40s: the concept of taking a temporary hiatus from their careers for a mini retirement. While some may perceive this as a self-centered action, it does come with a trade-off, involving a reduction in income during one’s most productive working years. However, embarking on a mid-life retirement can also be interpreted as a rejuvenating interlude, during which one can delve into various aspects of life beyond work.

This approach enables the opportunity to relish retirement-like experiences without deferring them until old age. It involves embracing the idea of committing to work for a year or two, followed by a brief span dedicated to indulging in travel and leisure pursuits. Upon re-entry into the workforce, the transition can be seamless, moving into a different job or role. While it does require careful planning, this strategy presents a distinctive chance to enjoy the post-child-rearing phase and the vibrancy of youth, all the while ensuring that personal fulfilment is derived from one’s pursuits.

18. Build a Contingency Fund

It’s advisable that you’ve been diligently building and consistently maintaining your emergency fund. As time goes on, especially during your 40s, you might want to consider increasing the size of this fund. It can prove invaluable for significant life events like a child’s wedding or financing their education. Always commit to replenishing the fund after using it.

This is also a suitable juncture to contemplate whether a portion of these funds could be better utilized elsewhere. Allocating some funds into a taxable investment account could offer great potential to grow your wealth. Safeguarding an emergency fund remains crucial for navigating unexpected challenges, particularly during your high-earning years.

Financial experts often recommend having 3 to 6 months’ worth of living expenses in reserve, although some advocate for a cushion of up to 12 months. However, it’s essential not to expose too much of the fund to risk, as you need to ensure it is readily available for genuine emergencies.

19. Secure Life Insurance Coverage

Opting to maximize your savings within retirement or taxable investment accounts may not yield optimal results if your family is compelled to prematurely deplete those funds. In the unfortunate event of your passing without life insurance, your spouse or other dependents might need to allocate the accumulated assets for funeral expenses and debt settlement, diverting resources that could have otherwise supported their own retirement aspirations.

Procuring a life insurance policy can provide assurance that the funds diligently set aside for your retirement will be preserved for their intended use. Among the available options, term life coverage usually emerges as the most budget-friendly choice for individuals in their 40s. On the other hand, a whole life policy offers the advantage of building cash value over time. When contemplating a whole life policy, it’s prudent to evaluate the potential returns on your investment in comparison to the elevated premium expenses. This is one of the best ways to build long term wealth.

20. Secure your Family’s Future with Term Plans

Term insurance stands out as the most cost-effective and uncomplicated insurance option in today’s market. Within the realm of life insurance policies, a term plan boasts notably reasonable premium rates while ensuring a substantial sum assured for policyholders. Additionally, you have the option to amplify your protective coverage by procuring add-ons like the Accidental Death Benefit, Accidental Disability Benefit, or Critical Illness Riders.

When deciding on the ideal term plan for you, factors such as your current lifestyle, income, expenses, and financial obligations should serve as your guiding criteria. Whether it’s your mortgage, vehicle loan, or credit card debt, it’s crucial to ensure that your term insurance payout sufficiently covers these financial obligations. If you have substantial liabilities in your 40s that are expected to diminish over time, choosing decreasing coverage could be a suitable option. To secure the most favourable term insurance rates, maintaining good physical health is essential. Now you know why building wealth is important and how you can do it.

21. Invest in Health Savings Accounts

Health savings accounts (HSAs) function as personal savings accounts designated for covering healthcare expenses, with exclusive ownership and control by the account holder, rather than an employer or insurance company.

These accounts enable tax-free deposits and require eligibility through a high-deductible insurance plan. Unlike a 401(k) that might be employer-associated, HSAs remain independent. As long as the health plan fulfils deductible criteria and allows HSA establishment, and the account holder isn’t on Medicare or claimed as a dependent, various HSA administrators like banks, credit unions, and insurance companies can be chosen.

Funds can be withdrawn without tax implications for qualified medical costs. HSAs provide a triple tax advantage: contributions employ pre-tax funds, earnings accumulate tax-exempt, and withdrawals for medical expenses are also tax-free. Post turning 65, the account holder can utilize HSA funds for non-medical expenses, subject only to income tax without penalties.

22. Obtain Disability Insurance Protection

Failing to secure sufficient disability insurance stands out as a major oversight among individuals who want to learn how to build wealth in your 40s. In the event of an unforeseen accident or sudden illness, the capacity to support their family might diminish significantly. Those equipped with disability insurance typically possess the financial means to navigate their circumstances until recovery.

While disability can strike at any life stage, its significance is amplified for those in their 40s. This period often corresponds to the pinnacle of career advancement and income generation. Thus, procuring disability insurance becomes not just essential but imperative, tailored to one’s earnings and existing lifestyle.

The acquisition of disability insurance is a vital step for people in their 40s, as well as a prudent move for all. Regrettably, some individuals, even under extensive coverage, encounter claim rejections. Should this situation arise, it becomes crucial to delve deeper into the matter and advocate for entitled benefits. This is one of the best ways to build long term wealth.

23. Prepare for Your Children’s Education

Including savings for your children’s education is an important aspect of your financial checklist if you are a parent. The cost of college education has surged to an average of $35,331 per student per year, with an annual growth rate exceeding 6%. While certain students might be eligible for scholarships or financial aid, there will likely be significant out-of-pocket expenses for many. To secure your children’s future, establishing a college savings account is advisable.

Among the various options available, a 529 plan stands out due to its associated tax benefits. This plan enables parents to contribute funds that can be subsequently invested. These investments can grow without incurring taxes during the accumulation phase. When withdrawals are eventually made, they remain tax-exempt, provided they are allocated for qualified educational expenditures. It’s important to note that deviating from this purpose could result in tax penalties. Consequently, opting for a 529 plan should be based on your confidence in your children’s pursuit of higher education.

24. Craft an Estate Planning Strategy

Estate planning becomes increasingly crucial as you want to know how to build wealth in your 40s. While estate planning predominantly revolves around posthumous arrangements, the act of cultivating and safeguarding your wealth in the present extends beyond merely safeguarding your loved ones upon your passing. It can serve as a means to augment generational prosperity over the long haul.

Exploring diverse trusts and considering the advantages of bestowing your wealth as gifts rather than awaiting taxation upon transfer could be beneficial. Deliberating on matters of power of attorney and healthcare proxy also holds significance. Seeking guidance from an estate planning specialist can aid in comprehensively orchestrating these aspects.

The advantages of establishing an estate plan far surpass the temporary inconveniences and expenses associated with its creation. Such a plan ensures that your family members possess unequivocal guidance in the event of your incapacity to make decisions, simultaneously maximizing the portion of your assets that will be inherited by your beneficiaries.

25. Downsize your Residence

After their children have grown up and left, many individuals in their late 40s make the decision to downsize from their larger family homes, opting for smaller residences with reduced square footage. In these circumstances, two main options become apparent: taking advantage of a thriving real estate market by selling their current property or retaining ownership of their primary dwelling and repurposing it as a rental property.

Transforming a primary residence into an investment property offers several potential advantages. These include the possibility to deduct operating expenses and factor in depreciation when filing taxes. Additionally, this choice unveils the prospect of generating supplementary rental income that could prove to be a valuable asset not only during retirement but also in the years to come. This is one of the best ways to build long term wealth.

26. Set aside Funds for Purchasing a Home

Should your financial situation harmonize favourably with your desired location, your 40s could present an ideal phase to adopt a more resolute approach to becoming a homeowner. It’s prudent to set your sights on keep aside a down payment equivalent to 20% of the home’s value.

This strategy serves a dual purpose: firstly, it negates the requirement of procuring private mortgage insurance—an extra expenditure designed to safeguard the mortgage lender in situations where payments are defaulted; secondly, it confers a palpable financial advantage. By furnishing a down payment of 20%, you effectively bypass the need to secure this coverage, resulting in substantial monetary savings.

27. Make Informed Vehicle Purchases

Reaching a point where you desire to treat yourself, consider opting for a certified pre-owned vehicle to make an impression on your neighbours without derailing your savings plan. The financial impact is almost neutral, with a slightly higher maintenance cost for an older model, but the initial investment is significantly lower.

Choosing a vehicle that’s three years old is recommended, as the most significant depreciation occurs in the first two years. This choice maximizes your savings. Despite factoring in a reduced trade-in value, consistently following this approach each time you change cars—given that the average duration is around five years—can lead to greater retirement funds in the long run. Now you know why building wealth is important and how you can do it.

28. Draft a Will

Gathering a set of documents is crucial for you and your family in case of your passing or incapacity. Starting with a will, this document not only designates the recipients of your assets but also enables you to appoint a guardian for your children if needed. A will provides clarity amidst potential confusion, streamlining asset distribution and alleviating any disputes among your loved ones.

Streamlining your family’s process, a living will outlines your end-of-life preferences, while a durable power of attorney for healthcare empowers a chosen individual to make medical decisions on your behalf when you cannot. Additionally, a durable power of attorney for finances grants authority over your financial matters. Whether creating or updating a will, taking these steps ensures your assets are managed according to your desires. This is one of the best ways to build long term wealth.

29. Arrange Consultations with a Financial Expert

If the prospect of handling all this planning feels overwhelming, a viable solution could be seeking assistance from a financial advisor. Seasoned financial advisors possess extensive experience and can tailor their approach to meet your specific financial objectives. They’ll adeptly develop financial strategies that harmonize with your requirements and income, also aiding you in determining your priorities – such as prioritizing retirement savings over college funds.

It’s noteworthy that you should aim for an expert who is compensated directly, perhaps on an hourly basis. These fee-only advisors are generally more inclined to avoid potential conflicts of interest compared to those who receive compensation from large financial corporations. Your objective is to have a reliable advisor who acts in your best interests. Here are other essential attributes to look for in a financial advisor.

If your sole requirement is assistance with managing your investment strategy, then a suitable choice could be a robo-advisor. It can establish an investment plan based on your timeline and risk tolerance, often at a lower cost compared to a human financial advisor.

30. Enhance Financial Literacy

Gaining financial knowledge is a powerful asset for enhancing your potential to grow your wealth and savings. Being well-informed not only boosts your confidence but also equips you with the skills to manage your finances effectively.

Expanding your understanding of various subjects such as investing, credit card mechanisms, credit scores, future-oriented savings, insurance, retirement planning, and taxation can make a substantial difference. This financial literacy empowers you to make informed choices, be better prepared for your financial future, and navigate unforeseen challenges with more confidence.

Leverage online resources to access easily digestible information, such as webinars, articles, videos, tools, and podcasts. Several platforms offer valuable starting points for your financial learning journey. Take the time to understand your current savings products and explore opportunities to maximize their benefits. Additionally, delve into financial and investment terminologies that might seem complex, ensuring you comprehend them fully. Now you know why building wealth is important and how you can do it.

31. Invest in Skill Enhancement

Acquiring new skills in your 40s is a potent method to amass wealth. This encompasses learning languages or taking courses to bolster professional prowess, fostering higher income, bolstered job security, and heightened financial stability. Such an endeavour unlocks pathways to diversify earnings, access better-paying positions, and even initiate small side businesses. This augmented income can extinguish mortgages, clear credit card debts, bolster retirement savings, or fuel other financial pursuits.

Furthermore, upskilling maintains competitiveness in the job arena and facilitates alignment with evolving industry trends, culminating in fortified job security and potential for enhanced compensation and perks. However, it’s crucial to acknowledge that acquiring skills necessitates an investment in terms of time and money – education expenses like courses, conferences, and specialized training should be accommodated within financial planning, factoring into retirement objectives.

Ultimately, honing or acquiring abilities is a sound economic choice, yielding long-term benefits. Elevating expertise ensures a brighter financial future and amplifies personal and vocational satisfaction. This is one of the best ways to build long term wealth.

32. Explore Career Changes

Embarking on a career change in your 40s and leaving behind an industry you’ve invested a significant portion of your adult life in can be a daunting prospect. However, it also has the potential to be incredibly invigorating, especially when this shift aligns with your true aspirations. A midlife career transition is well within reach, regardless of your current situation. To enhance the likelihood of a successful switch, consider employing these strategic approaches.

Given your transition at this stage involves a wealth of experience and skills, many of which can be transferred to new contexts, take pride in your professional history. Showcase your adaptability and express a genuine eagerness to acquire novel knowledge and competencies. It’s important not to assume that your age is a detriment; what employers are ultimately seeking is the most qualified individual for the position, and your task is to effectively convey why that individual should be you.

Recognize that while you’ll be the one carrying out the tasks in your new role, your decision will invariably impact others as well. Not seeking input from your family and overlooking their concerns during the early stages of this process could potentially lead to conflicts further down the line.

33. Motivate Your Children to Take Wise Financial Decisions

Now is an opportune moment to guide your children towards sound financial decisions instead of just providing for them. Ideally, this guidance should have begun earlier, but initiating their financial education can happen at any point. It’s never too late to start teaching your children about wise financial choices and motivating them to achieve financial self-sufficiency. This approach will spare you concerns about funding them and allow you to fully enjoy your retirement.

Reflect on the conversations and attitudes surrounding money that your children are exposed to. Do these align with the financial values you wish to impart? If not, addressing any deficiencies in your own financial practices will naturally influence your parental guidance on this subject. Now you know why building wealth is important and how you can do it.

Also Read: How to Build Wealth in Your 30s

Even if you’re in your 40s and concerned about not having sufficient funds for retirement, remember that there’s always time to take action and improve your financial situation. By adopting sensible economic habits and capitalizing on opportunities, you can navigate the complexities of this decade and achieve your long-term wealth goals.