It is crucial to plan early to build wealth, and your 20s present an ideal opportunity for this economic feat. However, figuring out where to begin can be confusing. To assist you, we will explore essential strategies and valuable insights on how to build wealth in your 20s. By adopting smart habits and making informed decisions, you can lay the foundation for a financially stable future.

Table of Contents

How to Build Wealth in Your 20s

In your 20s, achieving your financial goals might appear challenging, especially considering the financial burdens many young individuals face. According to a credit report by Experian, the average debt for Gen Z consumers under the age of 24 is $10,942, and this number tends to increase as one moves into the Millennial age group (ages 25 to 40) with an average debt of $27,251.

However, don’t be disheartened, as you can still grow your wealth with wise money management and smart choices. Here are valuable guidelines to help you accumulate wealth during your 20s, ensuring long-term benefits for your financial future!

1. Do a Job and Maximize your Earnings

In your 20s, it’s essential to explore various opportunities to boost your income and set the foundation for a prosperous future. Not every opportunity may be your passion, but each one can enhance your earning potential and equip you with valuable skills for career advancement. Dedication and hard work are crucial in any job you undertake.

To achieve wealth, prioritize career choices that lead to higher earning potentials. Continuously seek ways to increase your income and consider acquiring relevant degrees or credentials in your field to unlock further earning opportunities. Remember, the efforts you put in now will lay the groundwork for financial success in the long run. This is one of the best ways to build long term wealth.

2. Outline your Investment Objectives

In the investing process, you play a critical role in creating structure and purpose for your money. Instead of saving aimlessly, you have the opportunity to define a clear financial roadmap that aligns with your specific goals. By carefully breaking down your financial objectives into short, medium, and long-term goals, you pave the way for a successful journey.

With well-defined investing goals, you empower yourself to make informed financial decisions that support these objectives. This involves determining the right investment accounts to use, setting appropriate savings targets for each account, and selecting specific investments that suit your plans. By taking these steps, you can optimize your financial decision-making and work towards achieving your goals. Now you know how to build wealth in your 20s.

3. Select Investments that Align with Your Risk Tolerance

Investing inherently involves risks, and it is essential to understand and assess our personal risk tolerance. By gauging how comfortable we are with risk, we can create a suitable investment strategy aligned with our individual preferences. To build an effective investment portfolio, we must also consider our specific financial goals.

For long-term investment goals like retirement planning, a more aggressive approach is generally suitable. This involves including higher-risk assets such as individual stocks and high-yield bonds. Over an extended period, there is ample opportunity for investments to rebound and substantially grow your wealth. Historically, the average long-term stock market return has been around 10%.

Conversely, short-term investment goals, like saving for a down payment on a house, require a less aggressive strategy. A portfolio with lower-risk assets, such as cash or treasury bonds, is more appropriate in this case. The reasoning behind this approach is that short-term fluctuations in the market may not leave enough time for our investments to recover before the funds are needed for our immediate objectives.

4. Create a Personal Budget

This is one of the best ways to build long term wealth. Take charge of your financial future by creating a well-structured personal budget. One of the most straightforward approaches is the cash system, wherein all expenses are paid using physical currency, and specific amounts are designated for different budget categories. Alternatively, one can opt to restrict purchases to a predetermined percentage of their income.

Utilize budgeting apps like Mint, Personal Capital, or Honeydue to track your expenses effectively, and if you share finances with a partner, these apps can help both of you stay accountable. The key is to establish a budget and stick to it diligently, avoiding the dreaded paycheck-to-paycheck cycle.

5. Reduce Living Expenses

Keep your living expenses in check by implementing budget-conscious strategies. Resist the allure of unnecessary purchases, like those tempting deals on Amazon. Embrace frugal living by cooking at home, considering a roommate to share expenses, or cutting back on luxury subscriptions like cable TV. Saving money on daily expenses means more funds available for investments, accelerating your journey towards financial growth. Reevaluating your transportation choices can be advantageous.

If you are already leading a modest lifestyle, explore additional avenues such as cutting down energy expenses or welcoming a roommate to your residence. Even minor adjustments can free up more money and aid in establishing financial stability during your 20s. Now you know how to build wealth in your 20s.

6. Increase Retirement Contributions

Secure your future by boosting your retirement contributions. Saving around 20 percent of your income is recommended for individuals in their 20s to ensure an adequate retirement fund. Maximize your contributions to retirement accounts such as 401(k)s or Roth IRAs. If you have the means, it’s advisable to contribute the maximum allowed amount of $6,500 per year to an IRA.

Capitalize on the power of compound interest and tax advantages to grow your wealth through retirement savings over time. Starting early is the key to accumulating substantial wealth, as even modest monthly contributions can compound into significant amounts by the time you retire.

7. Increase Income for Future Wealth

Instead of getting overly fixated on maximizing investment returns, it’s advisable to prioritize increasing your income, as it plays a significant role in building wealth. Wise investments tend to grow on their own, allowing you to focus on enhancing your income rather than worrying about your financial portfolio. In your 20s, your future wealth largely depends on the gap between your income and expenses.

Cultivate multiple income streams and invest in self-improvement to boost your earnings while living within your means. This can be achieved through several approaches, such as engaging in a side hustle and initiating the creation of assets. By diversifying your income streams in these ways, you can enhance your financial situation and achieve greater financial stability. This is one of the best ways to build long term wealth.

8. Earn Passive Income

Passive income refers to earnings generated from assets that require minimal or no ongoing effort on your part, often resulting from work you previously completed but no longer actively engage in. This type of income is instrumental in building wealth over time without constant active involvement. Various examples of residual passive income include receiving royalties from books authored, generating revenue from advertisements on personal blogs or websites, and selling digital products like e-books, online courses, workshops, or videos.

Additionally, renting out a room in your home, establishing an online store, or participating in cash-back shopping apps that offer rewards for everyday purchases are other viable options for generating passive income. By setting up these sources of income, you can steadily accumulate wealth without continually trading your time for money. Now you know how to build wealth in your 20s.

9. Allocate Extra Income Wisely

Put any windfall or additional income to good use by earmarking it for your financial goals. Whether it’s a raise, bonus, or unexpected inheritance, don’t let these opportunities slip away. Employ a smart 50-50 strategy, directing 50% of extra income towards improving your quality of life while wisely allocating the other 50% to savings or investments. Similarly, apply this strategy to tax refunds to make the most of unexpected financial boosts.

It’s essential to prioritize financial goals and objectives. Diversify your money across different asset classes, such as stocks, bonds, and real estate, to spread risk and maximize potential returns. Prioritize saving for short-term goals, such as buying a house, funding a vacation, or pursuing further education. Allocate funds to these objectives to avoid the need for borrowing in the future. Remember that striking a balance between saving, investing, and enjoying the present is crucial for long-term financial success.

10. Grow your Savings

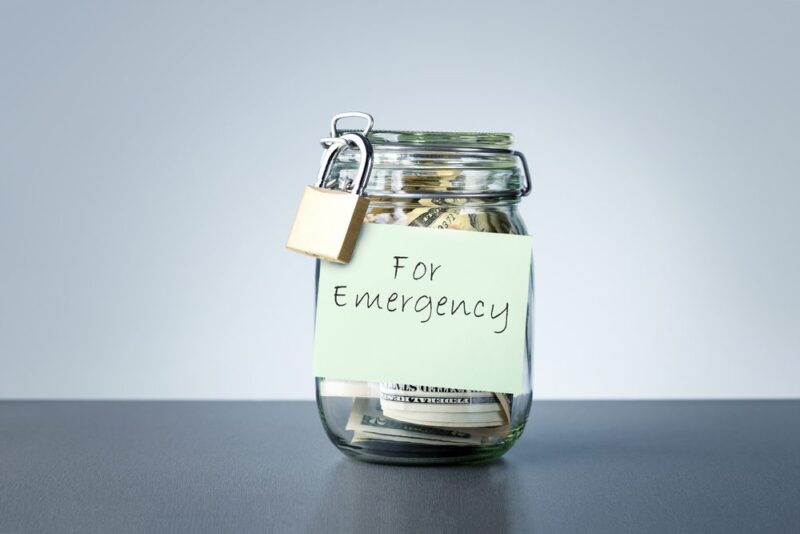

This is one of the best ways to build long term wealth. In the pursuit of financial security, it’s easy to prioritize bills and retirement savings and neglect the enjoyment of our hard-earned money. However, it’s essential to recognize the significance of building savings, particularly an emergency fund. Even though you may feel invincible in your 20s, unexpected challenges can arise. Setting aside funds in a savings account provides a safety net in case of job loss or accidents. Furthermore, saving money can be a stepping-stone towards achieving your entrepreneurial dreams.

Having substantial savings can empower you to leave your job and venture into your own business. Cultivating the habit of saving now will prove beneficial not only in your 30s, 40s, and 50s but throughout your life. To make the most of your savings, opt for a high-yield savings account, maximizing the returns on your hard-earned money. By being wise about saving today, you can pave the way for a more secure and fulfilling financial future.

Also Read: Best Savings Bank Accounts For Children In India

11. Manage and Reduce Debt

Managing debt should be a top priority to safeguard your financial gains, particularly when dealing with credit card debt, which often carries a substantial interest burden, averaging around 14.75%, but sometimes reaching as high as 20% or 30%.

To tackle credit card debt effectively, it’s crucial to prioritize making at least the minimum payments regularly. Additionally, consider allocating any extra funds toward reducing the principal amount owed. Exploring the option of consolidating debt into a lower interest rate can also be beneficial. However, in some cases, it might not be necessary to rush into paying off student loan debt immediately, especially if your investments are generating better returns. Still, it is essential to meet the minimum payment obligations for student loans without fail.

Clearing your debts will not only improve your credit score but also enhance your purchasing power. By avoiding additional debt and steadily chipping away at existing balances, you’ll reduce stress and free up more funds for building wealth instead of paying unnecessary interest. Now you know how to build wealth in your 20s.

12. Start a Business

I t’s essential to explore wealth-building avenues that offer quicker returns compared to traditional long-term investments. One highly effective approach is to venture into entrepreneurship and establish your own business. Starting a business early can be a fantastic way to build multiple income streams and foster wealth creation. You need not quit your day job right away; additional income can be generated through part-time work, side hustles, or investing in assets like real estate investment trusts (REITs) to receive dividends.

Being a business owner provides tax advantages that are not available to those who work as employees. Take some time to assess your areas of expertise or interests, and delve into potential business opportunities that align with your skills and passions. This way, you can increase your chances of achieving financial prosperity and independence in your 20s. However, it’s important to be aware that this path also involves taking on additional risks.

13. Plan a Long-Term Investment Strategy

Investing your money for longer periods generally yields better results. This is because of the benefits of interest, which allows your investment to grow over time, and the added advantage of compound interest, which further multiplies your money. Notably, not only does interest accumulate on your initial investment, but it also compounds on the returns you’ve already earned.

During economic recessions, your investment portfolio might experience temporary declines lasting several months or even years. However, history has shown that the market has always recovered eventually. By starting your investment journey early, you provide your money with more time to bounce back from these downturns. Building a well-diversified investment portfolio and maintaining a long-term approach can prevent impulsive buying or selling during market corrections.

This is one of the best ways to build long term wealth. Successful investing in your 20s requires steering clear of emotional decision-making during market fluctuations.

14. Keep in Mind Your Investment Fees

It is crucial to be aware of the costs associated with owning investments, such as expense ratios and 12B-1 fees. Even seemingly small fees can have a significant impact over time, especially when they accumulate on a growing account value. While we cannot predict market returns, we have control over the amount we pay in investment fees.

It’s important to understand that investment fees are applied regardless of whether the investment generates a positive return. Therefore, gaining a clear understanding of the fee structure of any potential investment should be a top priority. Compound interest can be both beneficial and detrimental. While it can grow your wealth substantially, it can also reduce the overall portfolio due to compounding fees. So, being mindful of these fees is essential to make the most out of our investments. Now you know how to build wealth in your 20s.

15. Invest in Stocks and Mutual Funds

Both individual stocks and mutual funds can play a role in a well-rounded investment strategy. Investing in stocks and mutual funds presents an opportunity for higher returns compared to keeping money in savings accounts or CDs, despite the inherent risks involved. The potential rewards can be significant.

When it comes to investing in individual stocks, the focus is on equity as a single asset class. However, mutual funds offer the advantage of encompassing multiple asset classes or sub-asset classes due to their ability to hold a diversified portfolio. By investing in mutual funds, you indirectly participate in the share market. Individual stocks have the potential for higher returns but come with higher risk, while mutual funds offer diversification and professional management but might not provide the same growth potential as individual stocks.

Before deciding on the right mix of investments for your portfolio, it’s essential to carefully assess your risk tolerance, investment goals, and time horizon. It is crucial to prioritize thorough research and opt for low-cost, diversified funds.

16. Build a Rainy Day Fund

Shockingly, over 50% of Americans are unable to cover a $1,000 emergency expense with their savings. To accumulate wealth in your 20s or any stage of life, it is crucial to set aside a portion of your income each month. Many financial experts recommend having enough savings to cover 3 to 6 months’ worth of income.

Building an emergency fund becomes much more feasible as you work on paying down debt. This fund acts as a safety net, preventing the need to borrow money during unforeseen circumstances. Having additional funds at your disposal can prevent you from accumulating costly debts or resorting to tapping into your retirement savings in case of job loss, car or home repairs, medical emergencies, or unexpected expenses. It is essential to keep this money separate from your regular checking account to resist the temptation of using it for everyday expenses. This is one of the best ways to build long term wealth.

17. Automate Your Finances

To make investing a regular habit, automation can be very helpful. You can achieve this by setting up automatic contributions to your investment account through payroll deductions or scheduling regular transfers from your bank. With automatic transfers, you won’t have to worry about missing payments or second-guessing yourself.

You can make your financial life hassle-free by automating your money management. Set up recurring payments for bills, retirement contributions, personal savings, and emergency funds. Regularly review your payments to optimize your savings and investments, ensuring your financial plans stay on track and adapt to changing circumstances. For those without an investment account, it’s now easier than ever to get started. You can easily open an online brokerage account in just a few simple steps. Now you know how to build wealth in your 20s.

Also Read: 10 Best Discount Brokers in India (2023)

18. Find a Financial Advisor

Having proper financial guidance can significantly enhance your financial stability! While educating yourself through personal finance literature and courses is beneficial, having a advisor or mentor who understands your lifestyle can provide tailored advice. Someone with more experience in handling finances would be ideal as a financial advisor, as they can offer reliable advice based on their own experiences.

In your 20s, it’s common to struggle with understanding the bigger financial picture. A advisor or role model can play a vital role in helping you navigate this new territory and manage your finances effectively.

19. Enhance your Financial Knowledge and Understanding

This is one of the best ways to build long term wealth. Building wealth in your 20s requires a strong grasp of money matters and street-smart financial decisions. Educate yourself through books, articles, and trusted financial resources to gain valuable insights into money management. Understand the power of budgeting, saving, and investing early on to harness the potential of compounding.

Cultivate a mindset that values long-term goals over instant gratification, making sound investment choices to grow your wealth and money steadily. Stay informed about economic trends and financial markets to adapt your strategies as needed. Ultimately, mastering financial independence at a young age sets the stage for a prosperous future.

20. Invest in Personal Development

Investing in yourself is a wise long-term strategy. In the ever-changing landscape of the future, having a diverse skill set enhances your ability to seize opportunities. Begin by impartially evaluating your talents and skills or seek unbiased opinions from trusted friends. Focus on personal and professional development to maximize your strengths. Taking language classes, attending networking events, or even obtaining a real estate license can open up new income avenues.

Self-improvement encompasses embracing every opportunity that arises and actively seeking to acquire diverse skills and knowledge. This involves thoroughly assessing your talents, interests, and skills to determine how you can best utilize them to their full potential. It might require investing resources, both in terms of money and time, to enhance and develop your education and abilities. The journey of self-improvement is unpredictable, and constant learning and steadfastly pursuing goals are essential elements of this transformative process. Embrace the unknown, perpetually expand your horizons, and remain resolute in your pursuit of personal growth. Now you know how to build wealth in your 20s.

21. Upgrade your Mind and Think Big

Being young and having a unique perspective allows you to notice opportunities that others might overlook. Embrace your creativity and think beyond yourself, envisioning bigger possibilities. Your mind is adaptable and agile, providing you with the ability to chart your path towards success and prosperity. Understand that failures are part of the journey, and it’s essential to take responsibility for them while celebrating your achievements. Keep pushing yourself to dream bigger and achieve more.

Successful individuals often attribute their accomplishments to their voracious reading habits. They continuously seek knowledge, learning new things, gaining experiences, and broadening their insights. Building wealth requires time, effort, and commitment. However, prioritizing personal growth and continuous learning equips you to adapt to change and make sound financial decisions that can lead you to achieve your goal of financial abundance by your 30s.

22. Surround Yourself with Positive Influences

Surrounding yourself with positive, successful individuals can be transformative. Elevating your standards and shedding negative relationships are essential steps to achieving greater success and happiness. Expanding your comfort zone and connecting with intelligent, hardworking people can elevate you to new heights of achievement. In a world where negativity and divisiveness can be prevalent, deliberately seeking positive influences can have a profound impact on your personal growth and accomplishments.

To stay focused on your goals, consider surrounding yourself with like-minded friends who share your interest in building wealth. The people you associate with can significantly influence your financial mindset and decisions. This is one of the best ways to build long term wealth.

23. Maintain your Passion and Motivation

Remaining passionate and driven is crucial when it comes to building wealth in your 20s. Building wealth is a challenging journey that requires consistent effort. While occasional setbacks may not cause permanent damage, it’s important not to let them become a recurring pattern that derails your progress.

Maintaining self-discipline is essential, and one effective way is to continually remind yourself of the reasons why you prioritize wealth building. Envisioning your successful future self can be a powerful motivation that keeps you going, rather than getting stuck on the obstacles you may encounter along the way. By staying passionate and driven, you can pave the way to financial success in your 20s and beyond. Now you know how to build wealth in your 20s.

24. Don’t Fear Failures

In your 20s, one of the most effective ways to grow both personally and professionally is to make multiple attempts. Instead of waiting around for a raise, take the initiative and send out your resume to ten different companies. Remember, it only takes one positive response to land that higher-paying position. Don’t let the fear of rejection hold you back. If you had allowed that fear to control you, you might still be stuck at your old job earning far less than what you deserve.

If you face rejection, simply shrug it off and keep moving forward. One vital lesson you’ve learned is that successes tend to stick with you and propel you further in life, while failures are often forgotten much quicker than you anticipate. By making more attempts, you position yourself to accumulate more successes, even if it means experiencing some failures along the way.

Also Read: 35 Legit Ways to Become Rich in India 2023

Keep in mind that wealth extends beyond simply earning a substantial income – it includes having ample resources to meet all your desires and necessities. Building wealth in your 20s requires discipline, smart decisions, and a long-term outlook. By following the aforementioned steps and staying committed to your financial goals, you can set yourself up for a more secure future.