Monetary instruments such as debit and credit cards have made life easier for many people over the years by saving their money. There are some requirements that must be met in order to apply for them. Social Security Number (SSN) is one of these requirements that a US citizen must meet, but it is difficult and time-consuming. Therefore, you should know about virtual bank account, credit card and debit card without SSN to simplify the process of applying for a card. Read this article to know more.

Table of Contents

Best Credit Card and Debit Card without SSN

Given below is the list of the best credit card and debit card without SSN. These cards are great for those who want to avoid the hassle of applying for a traditional card with their SSN. But before we go further, let us understand what is SSN.

What is an SSN?

The Social Security Administration of the US provides a nine-digit number to permanent residents, working residents, and permanent US citizens. Earlier the number was used for tracking individuals but today it has a wider use as it has become an identification number that is used for stuff like taxation and more.

SSN came into existence in November 1936 and within three months 25 million such numbers had already been issued. Earlier SSN was allotted to people over the age of 14 but today a child can get one right after their birth. Now, let us check out debit card without SSN.

Best Debit Card without SSN

In the case of debit cards, one may not worry about SSNs as there are options for debit card without SSN. However, these debit cards might not be like traditional debit cards but are rather prepaid debit cards.

A prepaid debit card requires you to pay beforehand like a prepaid mobile service. So here you make the payments in advance and then use the balance on the card. Now that this is out of the way let’s look at the options that you have when opting for SSN-less debit cards.

1. Bluebird American Express Prepaid Debit Account

Amex is a well-known card issuer and so it shouldn’t come as a surprise that they offer their customers prepaid debit card options that require no SSN. The card is reloadable and can be used anywhere in the US as long as the place accepts Amex cards.

The card also supports direct deposits and so your pay comes to you 2 days earlier than usual with this card. The card also has certain eligible purchases that it covers for 120 days in case of accidental damage or theft.

This card can be accessed for free at 30,000 ATMs and you also have the option to add cash for free at Walmart. And you can also transfer money for free to Bluebird account holders.

The card comes with a team of customer service executives always available to help you. Also, this card has no annual fee or foreign transaction fee to levy on you. The card has gotten a rating of 4.6 stars and doesn’t impose a lot of charges on you. You can get this card by providing an ITIN in place of an SSN.

2. Serve American Express Prepaid Debit Account

If one Amex card wasn’t enough, then you now have another one as well. This is yet another Debit card without SSN and it also has received a 4.6-star rating out of 5.

The card can be accessed at 30,000 locations for free and the card also supports direct deposits due to which you can get your paycheck 2 days earlier than normal. The card is free of charge for anyone who at least once makes a direct deposit of 500 dollars or more in a statement period.

The online bill pay service that comes with the card helps you save time and avoid late fee payments. You get text messages and alerts and you can also send money, pay bills or check transactions on the go when you get this card. The card has no hidden fees and also no credit check is required to obtain it. You also don’t require to have any kind of minimum balance on this card and an ITIN can be provided instead of SSN.

3. Mango Prepaid Mastercard

Rated 4.6 out of 5 this Mastercard branded Prepaid debit card is another great option for you when you want to get yourself a card that does not ask for an SSN. The card comes with no hidden fees or interest charges. The card can be used at all Mastercard-accepting locations.

Activating and loading this card can get you the option of starting a savings account for as low as 25 dollars. The money in this account then gets you 6% APY and each month you can make 6 outbound transactions.

You can obtain this card by providing a personal code, ID code, or certain other numbers in place of an SSN. This card can be obtained without going through any credit checks. The card can be reloaded at participating Green Dot Bank retailers or by yourself through PayPal, direct deposits, and other ways. Now you know about some debit card without SSN.

Virtual Bank Account without SSN

It’s not just the debit card without SSN that is your only option. You can get yourself a virtual bank account or even a credit card without an SSN. The only thing to keep in mind is that it will severely reduce your options. To get a virtual bank account without providing SSN might sound simple but that is not the case and so to help you navigate through this difficult situation we have a little bit of something for you.

Virtual Bank Accounts

Not all banks provide the option of virtual bank accounts and even fewer have this option open for non-residents. Even if you manage to fund something for yourself as a non-resident, know that the account opening requirement for you will vary drastically for you and a US resident. Say if they have to deposit 100 dollars when opening the account you might be asked to deposit anywhere between 5,000 and 25,000 dollars.

This inequality takes place because a non-resident is considered a much more risky party to the bank as compared to the resident. A no-resident person can’t be verified easily nor is their address verification as straightforward as is for a resident and thus you will be treated much differently.

A virtual bank account without SSN might not be easy to get but there are alternatives that you could opt for like getting an ITIN. If you are a qualifying non-resident or an alien resident then you can try getting a US individual taxpayer identification number.

Those that can’t qualify for an SSN can go ahead and get ITIN which is a similar kind of number. Getting an ITIN again increases the number of options open to you as a non-resident. But while your options are increased it does not guarantee to get you an account if you don’t meet the other mentioned local requirements.

All in all just like a debit card without SSN it is possible to go ahead and score a virtual bank account without providing an SSN but it might be a bit more complicated than it is for debit cards.

Getting an ITIN does make things easier for you and you can then avail many options as a resident would. However, if you are not keen on getting an ITIN then you could consider alternative options like getting an account with a brick-and-mortar bank or something of that kind.

Best Credit Card without SSN

Just like debit cards, it is also possible to get a credit card without SSN. While debit cards become prepaid debit cards as soon as you remove the SSN credit cards remain the same. The nature of a credit card is not as much affected as a debit card but these credit cards may differ somewhat from the other credit cards based on the interest rate charged or other bases. Let us begin our list of credit card without SSN.

1. Bank of America Travel Rewards Credit Card

This credit card comes with a 0-dollar annual fee just as we saw in the case of most debit card without SSN. A 25,000 points welcome bonus awaits you with this credit card. The card has an APR between 18.24% and 28.24% and the credit score requirement to be eligible for this card is 700 to 749. The card comes with no hidden charges and rewards the user with 1.5 points per dollar spent using it.

The introductory APR on this card is 0% for 18 billing cycles. The balance transfer fee is 10 dollars or 3% of the transaction amount whichever is higher. The card also comes with 0-dollar fraud liability, warranty protection, travel emergency assistance, lost luggage reimbursement, roadside dispatch, and auto rental collision damage waiver benefits.

2. Deserve EDU Mastercard for Students

If you are an international student looking to get a great credit card that can be obtained without an SSN then you should consider getting this credit card. The card also doesn’t need an ITIN from you as your US home address and details of college and course will be enough to get you this card.

The card offers you 1% cashback on all purchases. If you spend 500 dollars in the first three billing cycles using this card then you get a year free on Amazon Prime student.

This card again comes with a 0-dollar annual charge. The APR of this card is 22.99% and this card does not ask you to have any kind of credit score to be eligible to sign up for it. This card also charges no foreign transaction fee from you making it more and more lucrative with each offering.

3. Capital One QuicksilverOne Cash Rewards Credit Card

For an annual fee of 39 dollars, you can get your hands on this credit card without SSN. The card comes with an APR of 29.74% and the credit score requirement is not much as even someone with a fair or average score can get it.

This card gets you unlimited 1.5% cash back on every purchase and not just that but you can also increase your credit line on this card in as less as 6 months.

Unfortunately, this card doesn’t offer any welcome bonus to its users but a 5% cash back on hotel and car rentals booked through Capital One can be availed by the users. The card also offers benefits like 0-dollar fraud liability and replacing a lost card quickly.

4. Capital One Platinum Secured Credit Card

If your credit score is bad or if you don’t have one then this card can be the one that can get you started. Just like you have debit card without SSN that is free of charge, this card is similar to those but instead of a debit card it is a credit card.

The APR of this credit card is 29.74% and there is also no foreign transaction fee on it. Again this card has no welcome bonus for you nor does it provide any rewards or benefits to the user apart from 0-dollar fraud liability and being able to check your credit score via the Capital One website.

5. Petal 2 Visa Credit Card

For this card with an APR between 17.24% and 31.24%, you pay 0 dollars in annual fees. The card has a reward rate of 1 to 1.5% in cash back. Again this card can be obtained by providing ITIN instead of SSN. It is one good credit card without SSN.

This case has no foreign transaction fee and no security deposit is required. Anyone with limited or no credit score also can sign up for this card.

It is an entry-level card that acts as a credit builder and so the card does not come with many rewards and also no balance transfers are allowed. The card also does not charge any late fee and they report your activities to 2 major credit bureaus which can be a good thing for you.

6. Capital One Quicksilver Secured Cash Rewards Credit Card

Again we have a credit card that is available for 0 dollars annual fee. This credit builder credit card comes with an APR of 29.74% and is available to people with no or limited credit history. The reward rate of this card is 1 to 1.5% in cash back and ITIN would be enough to get you this card.

This card gets you 5% cash back on rental and hotel bookings made via Capital One Travel. The card also gets you 6 months of Complimentary Uber One membership. The card also comes with benefits like 0-dollar fraud liability and an upgrade to a higher credit line in as less as 6 months.

7. Capital One Savor One Student Cash Rewards Credit Card

A student-oriented card with APR between 19.24% and 29.24% is available for 0 annual fees just like most debit card without SSN. The card has a reward rate of 1 to 5% in cash back and is obtainable with an ITIN. If you are looking for a credit card without SSN then this could be it.

The card also gives you 3% cash back on money spent on dining, entertainment, popular streaming services, and grocery store purchases. 8 and 10% cashback await you when Capital One Entertainment purchases or Uber & Uber Eats purchases are made using this card.

This card comes with 0 foreign transaction fees and with a 50-dollar reward bonus. You can also earn 500 dollars a year with referrals. The card has no hidden fees and offers a 0 dollar fraud liability facility to the user.

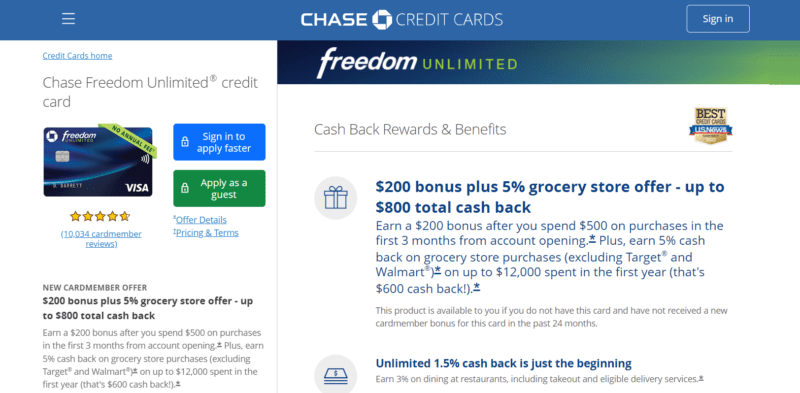

8. Chase Freedom Unlimited

For a 0 dollar annual fee this credit card with an APR between 19.24% and 27.99% is available to anyone without providing SSN. The credit score needs to be good to obtain this credit card that has a reward rate of 1.5 to 5%.

This card comes with a 0% introductory APR. The card gives you an additional 1.5% cashback on everything purchased in the first year up to 20,000 dollars which translates to 300 dollars. Many people consider this card as the best credit card without SSN.

With this credit card, you get an extra 6.5% cash back on travels purchased through Chase Ultimate Rewards and 4.5% on drugstore purchases and dining at restaurants, including takeout and eligible delivery service.

9. Blue Cash Preferred Card from American Express

If you have a gold credit score then you can get this card that is free for the first year. For an APR between 18.49% and 29.49%, this card comes for 95 dollars onwards from the second year. It is the last credit card without SSN on this list.

The card has a bonus offer of 250 dollars and a reward rate of 1 to 6%. With this card, you can get 7 dollars back if you spend 12.99 dollars each month on Disney Bundle.

You can also get 3% cash back on US gas stations and transits while 6% cashback is available on select US streaming subscriptions and at US supermarkets up to 6,000 dollars after which 1% cashback is available. Let us now learn how to activate a debit card without Social Security Number.

How to Activate a Debit Card without Social Security Number?

So we have seen a list of a debit card without SSN among others, however, the real question is once we have got this card what do we do with it? How are you supposed to activate this debit card and begin using it? Obtaining cards without SSN is a challenge in itself as your options are limited and then some alternate form of identification needs to be provided to get the card but now what about activation?

Worry not, we will tell you how to activate a debit card without Social Security number. It may sound very difficult but it isn’t.

Some companies may not let you use a card unless you provide SSN while others may allow you to use the card but you will only have limited access to it. Like, say a gift card given to you by a retailer may allow you to use the gift balance on the card but won’t allow you to recharge it unless you provide an SSN.

But luckily quite a few card issuers allow you to use the card as long as you provide information like Passport number, Driver’s license number, ITIN, alien registration number, or Native country’s identification number in place of SSN.

So if you just check with the issuer before signing up for a card then you can avoid any troubles down the road. You might also be asked to provide your home address, telephone number, and date of birth for identification and security purposes.

There are credit and debit card options available that do not require a Social Security Number. These alternatives cater to individuals who may not have an SSN or prefer not to use it for various reasons, providing flexibility and accessibility.